Key Takeaways:

Jio Financial Services collaborates with TaxBuddy and launched a Jio Finance App, provide features for affrodable tax planning and ITR filling @ Rs.24, allows taxpayer to select their correct tax regime and maximize tax deductions. Post ITR filling users can monitor return status, track refunds, and receive alerts for tax-related notices within the app.

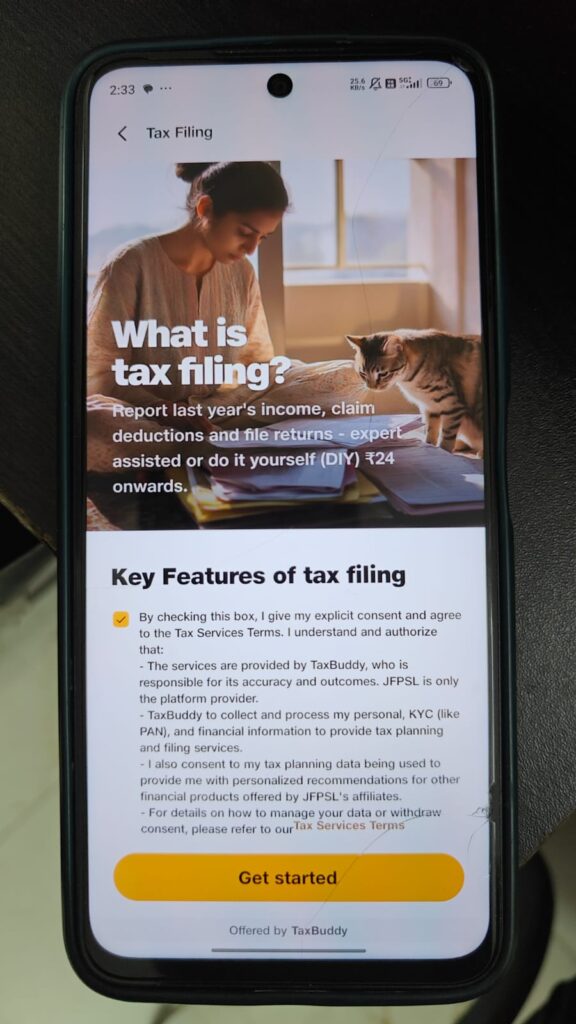

Jio Finance Tax Filing: Hello, taxpayers have got stuck while filling ITR and are having confusion between the old and new tax regimes, especially while claiming all eligible deductions like under 80C and 80D. But don’t worry guys, Jio Financial Services has introduced a Jio Finance App collaboration with TaxBuddy.

These Jio Finance income tax filing features from the Jio Finance App help users or taxpayers to eliminate their confusion between the new and old tax regimes, ensure they claim all eligible deductions to save money, and reduce the need for hiring expensive Chartered Accountants (CA) @ Rs.24.

The Jio Finance ITR filing App also allows users to select their correct tax regimes and maximize tax deductions. After filing the ITR, users can monitor return status, track funds, and receive notifications for tax-related notices within the app.

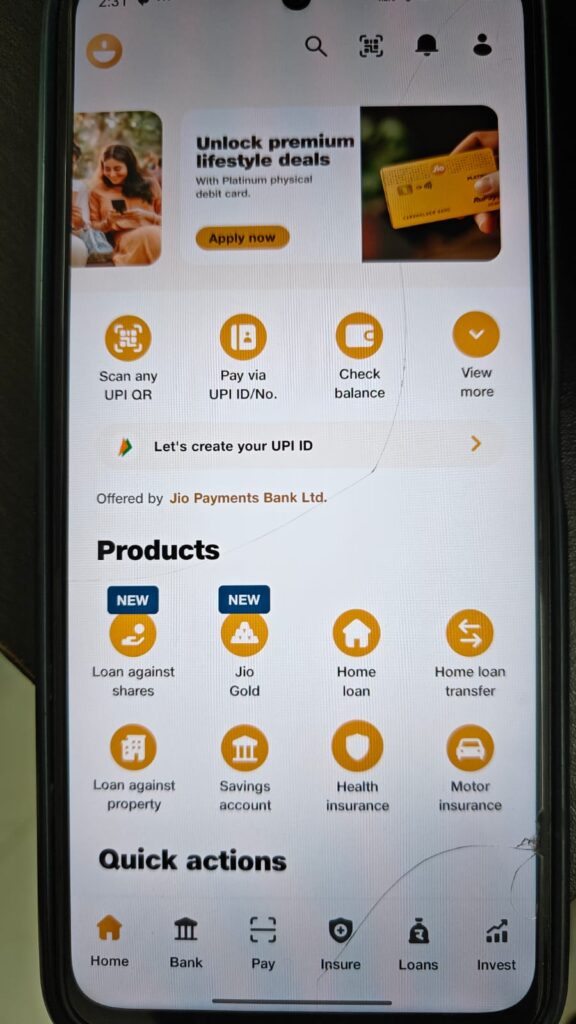

What is Jio Finance App & Core Features

JioFinance App is a finance app which is introduced in collaboration with Jio Financial Services Limited (JSFL) & Tax Buddy. It is a one-stop app for users to make fast, secure, and reliable payments, seamless bill payments, mutual fund investments, and personalized financial management.

Especially, it is one of the best apps for taxpayers, offering the best and advanced features for affordable tax planning and ITR filing. The new features on this app will guide users step-by-step, helping them to choose the right tax regime and maximize deductions.

One of the best parts of it is that, eliminates the need to hire an expensive CA or an intermediary. To bring unmatched convenience to taxpayers in India, a feature-packed tax planning and filing module has been introduced in the JioFinance App.

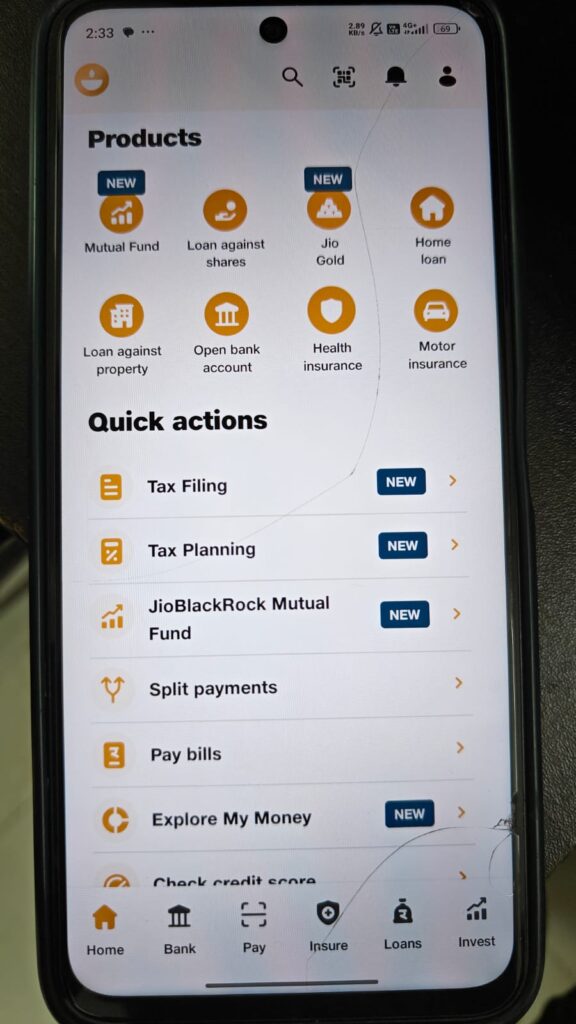

The new features on this app are designed to simplify, streamline, and make tax planning and income tax return (ITR) filing more affordable for people across India. Here are some of its key features mentioned below:

JioFinance App Module Core Features

The newly added module in the JioFinance App offers two core functionalities:

Tax Filing:

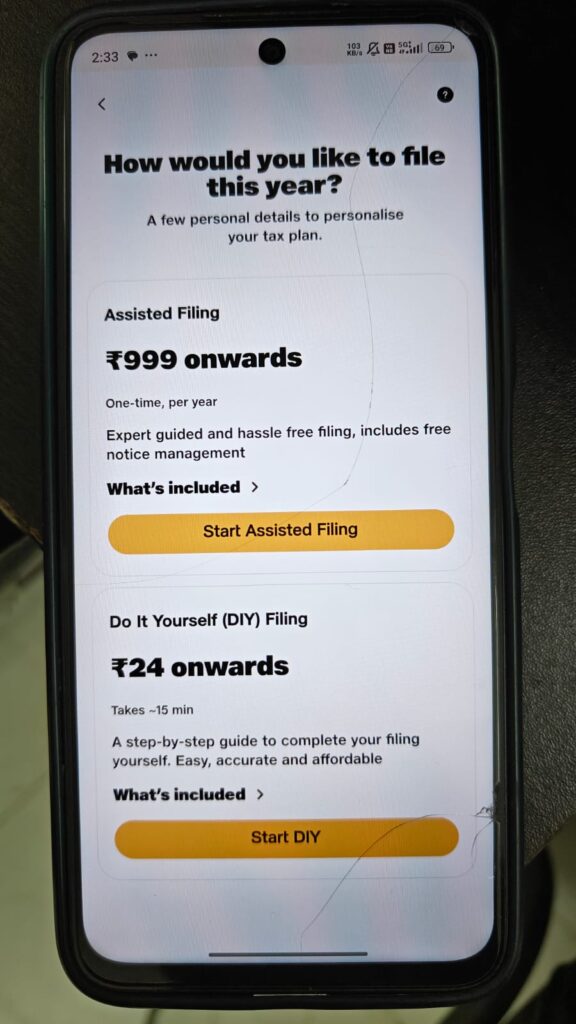

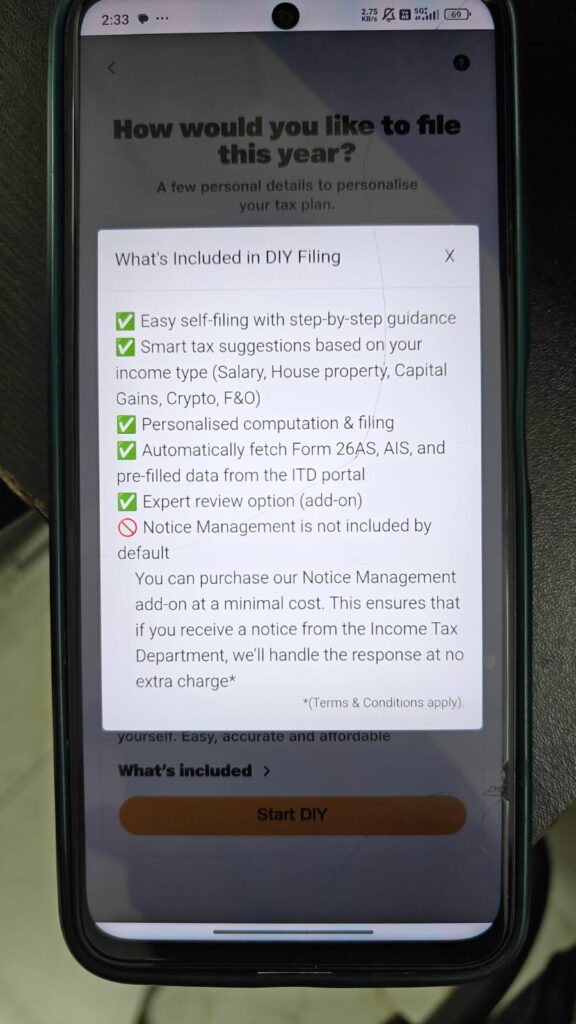

While using Jio Finance income tax filing feature, users can opt between self-ITR filing services starting at Rs 24 and or expert-assisted filing from Rs 999. The assisted services helped in resolving common filing issues such as confusion between old and new tax regimes, missed deductions under sections like 80C & 80D, and reliance on costly intermediaries.

Tax Planner:

The tax planner feature from the tool helps individuals plan and reduce future tax liabilities by mapping personalized deductions, assessing house rent allowance (HRA) eligibility, and comparing the new and old tax regimes for optimal savings.

If you are a Taxpayer and want to file your ITR, and are getting confused about which finance ITR filing app is best for you, then visit this list of ITR Filing Apps 2025 | Top Websites to Easily File Income Tax Return

Jio Finance Rs 24 Tax Filing Offer Details

| Feature | Details (as of Aug 2025) |

|---|---|

| Price | ₹24 (only for basic ITR-1 returns) |

| Eligibility | Likely for salaried individuals with Form 16 only |

| Form Type | ITR-1 (Sahaj) |

| Income Scope | Below ₹5 lakh, no capital gains, no business income |

| Support | Mostly app-based DIY, no CA consultation |

| Backend Filing Partner | Third-party ERIs or GST Suvidha Providers |

| Cross-sell Potential | High — loans, insurance, credit score upselling |

What Jio Finance Rs 24 Tax Filing Plan Misses?

- Capital Gains or Trading Income

- Rental Income or Multiple Form 16s

- Revised or Belated Returns

- Manual Review by a Tax Expert

- Tax Planning Advice

- Scrutiny Support or Notices Help

How to File an ITR in the JioFinance App?

Here is the step-by-step guide to fill out the ITR form using JioFinance App:

Step 1: First of all, download the Jio Finance App from Google Play Store & Apple App Store, or if you have already downloaded it, skip this step.

Step 2: Once you download the Jio Finance App, click on the Login option, and then OTP to complete the login process.

Step 3: Once you log in successfully, it will redirect you to the homepage of the Jio Finance App as shown above.

Step 4: After that, scroll down and navigate to the quick actions section, there you will see a Tax Filing & Tax planning option. Click on the tax filing option to proceed.

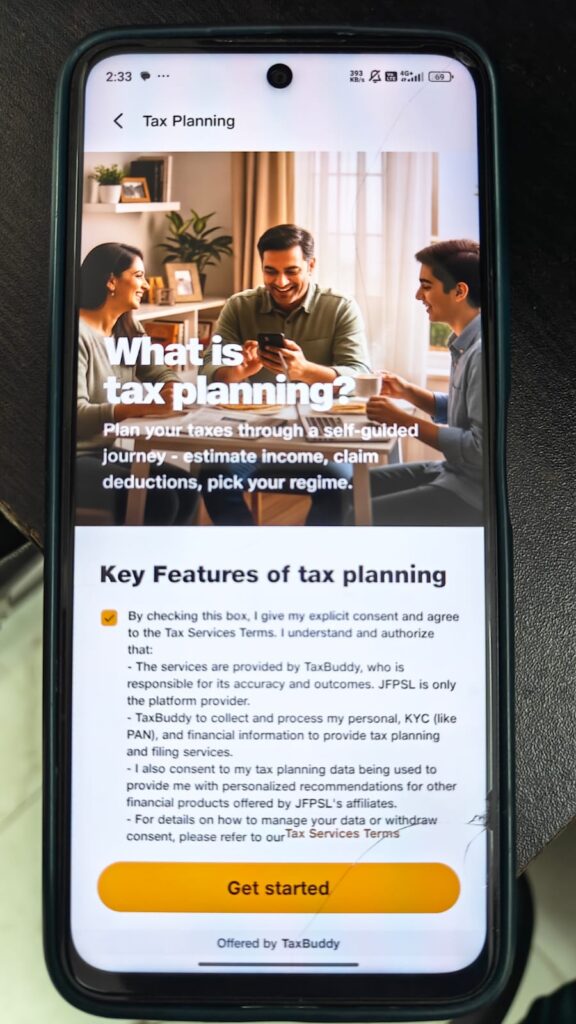

Step 5: If you want to plan for future tax liabilities, click on the tax planning option. Once you click on it, it will be shown as above. If you visited the app for tax planning, click on Get Started as shown above.

Step 6: Or if you are here to file your ITR, then click on the Tax filing option, and it will redirect you to the tax filing page shown above.

Step 7: Then, click on Get Started, and it will redirect you to a page, and you will ask, “How would you like to file this year?“, along with the Assisted Filing plan starts at Rs. 999 & Do It Yourself (DIY) Filing plan starts at just Rs. 24.

Step 8: Click on your plan that you wish to go with. Select the Rs.24 plan. Once you choose the Rs 24 plan, it will display the terms and conditions of the offer.

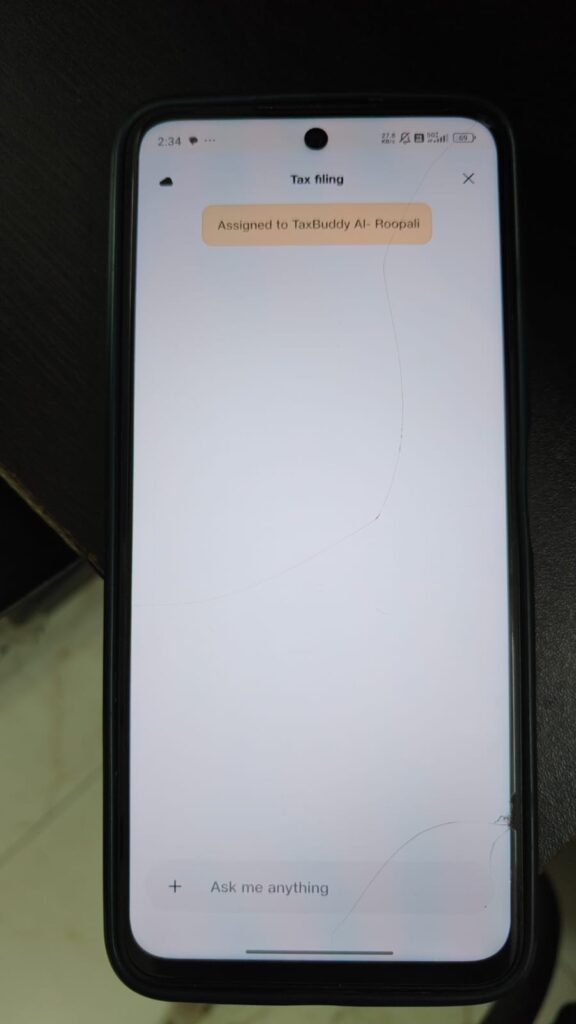

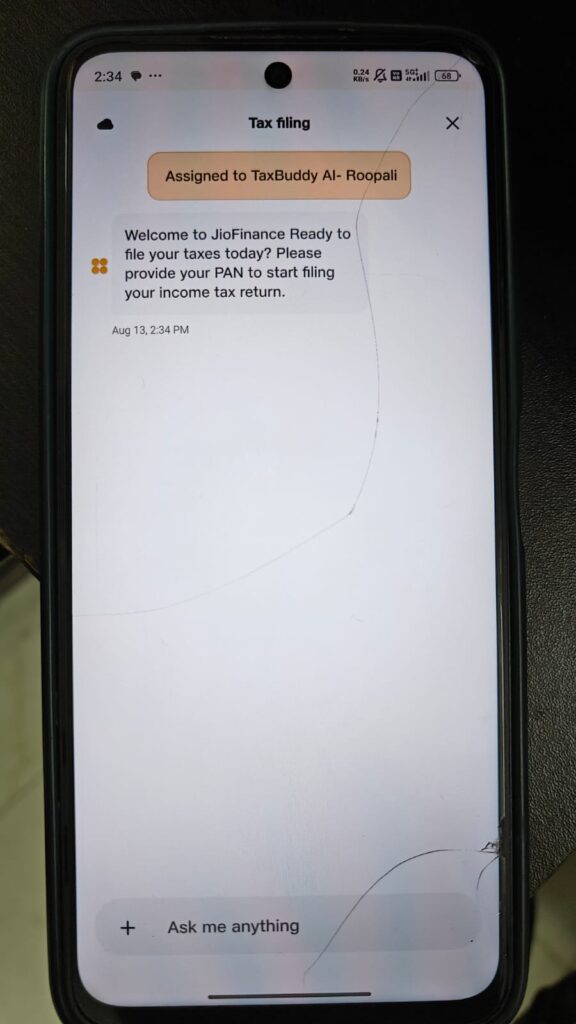

Step 9: After this, skip the terms and conditions when reading it carefully, then it will redirect me to the AI chat page, to file the ITR.

Step 11: After some time, it will display a message as: Welcome to JioFinance Ready to file your taxes today?, and you will be asked to provide your PAN details to proceed further.

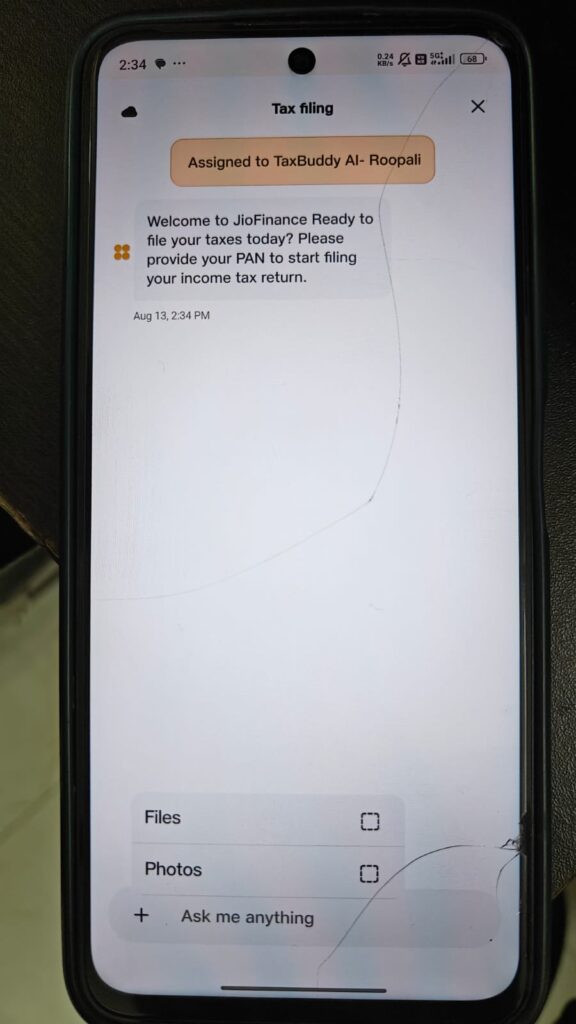

Step 10: Then, you will provide your PAN Details, other documents details by attaching the photos & Files by clicking on the + button at the bottom of the page.

Step 10: By following all the on-screen instructions, you will successfully file your ITR.

Aimed at Greater Convenience & Savings

JFSL Managing Director and CEO Hitesh Sethia announced the integration of a new feature with TaxBuddy’s platforms, aimed at simplifying tax filings and offering an effective year-round planning tool to help customers manage their tax liabilities.

The services address common taxpayers’ challenges, from choosing the right tax regime to claiming all eligible deductions, by combining automation with expert support for informed financial decisions at reduced costs.

While self-filing plans on other popular online tax platforms generally start between Rs.199 and Rs.499, and expert-assisted plans range from Rs.799 to over Rs.2000. Some other platforms also offer premium packages with personalized tax advisory, which can exceed Rs 3000.