Synopsis:

Amazon Pay & ICICI Bank have extended their long-standing collaboration for the Amazon Pay ICICI Bank Credit Card, marking a significant milestone in India’s co-braded credit card sector. The extension of their partnership effective from October 11, 2025, offers better travel benefits and lower foreign exchange charges to the country’s most widely used co-branded credit card, already trusted by over 5 million users.

Before few days ago, on 11 September 2025, Amazon Pay & ICICI Bank revealed that they extended the continuation of their collaboration. The credit card that has emerged as one of the fastest-growing co-branded credit cards across the country reflects the rising demand among Indian customers for value-oriented financial products.

The renewed collaboration places greater emphasis on travel and international use, aiming to serve the lifestyle of digitally savvy indian consumers who travel often and seek smarter global payment solutions.

Since its launch in 2018, the card has transformed digital payments by offering simple, transparent rewards along with seamless convenience.

What Exactly Is Their Partnership Extension?

Amazon Pay and ICICI Bank have extended and expanded their co-branded card partnership, which has already become one of the fastest-growing credit cards in India. The renewal highlights the growing demand for value-driven financial products and now places a stronger emphasis on travel and international spending.

The card is designed to match the lifestyle of digitally savvy indians who frequently travel and want smarter global payment options. Here are what new features that will be added for customers.

What’s New in It?

Lower Forex Markup:

The forex markup for international transactions has dropped from 3.5% to 1.99%, making the card very competitive with traditional credit cards.

Travel Benefits:

Prime Members: 5% unlimited cashback on flights and hotel bookings made through Amazon Pay.

Non-Prime Members: 3% unlimited cashback on flights and hotel bookings made through Amazon Pay.

With these ultimate changes, the card goes from being purely a shopping card to a more robust card for travel and everyday spending.

Also Read: PhonePe HDFC Bank Credit Card: UPI Integration, Rewards & How to Apply

Features & Benefits

- No Joining & Annual Fees: Offers a lifetime free card with no hidden charges.

- Shopping Rewards:

- 5% unlimited cashback on purchases from Amazon (excluding gold coins) for Prime members.

- 3% unlimited cashback for non-Prime members.

- Amazon Pay Categories: 2% unlimited cashback on payments made on Amazon pay categories like digital services and gift cards (not rent, taxes, and education).

- Other Spends: 1% unlimited cashback on spends outside of Amazon (excluding utilities, fuel, rent, taxes, education, and international transactions).

- Fuel Surcharge Waiver: 1% waiver on fuel transactions.

- No Cost EMI: 3-month no-cost EMI on eligible Amazon.in purchases available on an ongoing basis.

- Welcome Rewards: The card also provides welcome rewards worth up to ₹2,200 with an additional offer of ₹500 on Prime membership.

Creating Seamless Customer Experience With a Digital First Approach

- Existing ICICI Bank customers can get instant approval within 30 minutes of Video KYC.

- The entire application journey is 100% paperless and contactless, completed online via the Amazon website or mobile app.

- With broad acceptance for tap-and-pay transactions, it ranks among the most preferred cards for seamless contactless payments.

Director of Credit & Lending at Amazon Pay Views

The Director of Credit & Lending at Amazon Pay, Mayank Jain, emphasized that the brand focuses on delivering rewards that truly add value to customers, whether on everyday essentials or on big travel plans.

Echoing this, Vipul Agarwal, Head of Cards & Payment Solutions at ICICI Bank, spotlighted the card’s impressive growth, noting how the reduced forex markup and enhanced travel perks perfectly cater to the needs of today’s digitally savvy users looking for a smarter, more rewarding payment solution.

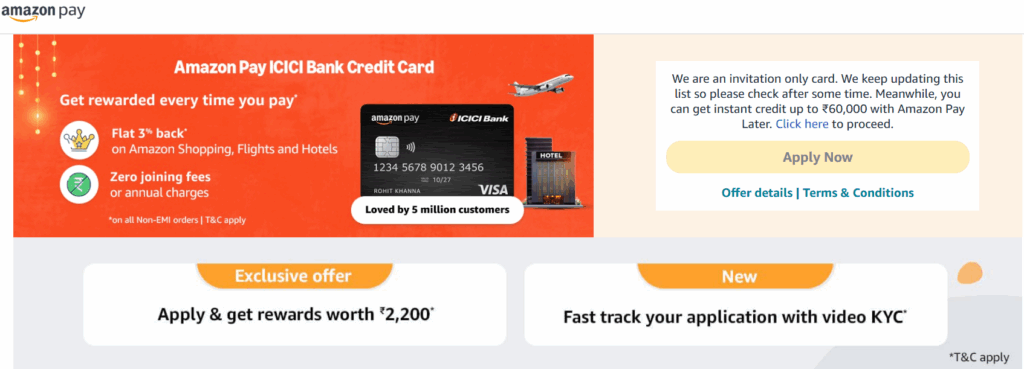

How to Apply for an Amazon Pay ICICI Bank Credit Card?

- Initially, the card was being offered to the selected customers only through invitation. ICICI customers who have been using the Amazon.in mobile application got the invitation in the form of a push notification from the Amazon app through email.

- On meeting the eligibility criteria, the customer can also apply for the card. The customer will receive a ready-to-use digital credit card first. The physical credit card will be dispatched through a courier service after that.

- However, an individual can also visit the ICICI Bank website and visit the Amazon Pay ICICI Bank Credit Card page under the ‘Product section’. From this page, he or she can click on the ‘Apply Now’ button.

- Once you click on the Apply Now button, it will redirect you to the Amazon website, where you can check whether he or she is eligible for the card.

- Similarly, an individual can also open the Amazon app on his or her smartphone and go to the Amazon Pay option under the main menu. Below are the steps given to apply it through the Amazon app directly.

Another way to apply for Amazon Pay ICICI Credit Card online.

1. First, you need to visit the Amazon Pay ICICI Bank Credit Card page and click on Apply Now.

2. Once you click on the link, it will direct you to the Amazon Pay ICICI Bank credit card application page, as shown below.

3. After this, you need to click on the ‘Apply Now’ button given on the page.

4. After this, follow the On-screen instructions to apply for the card.

Final Thoughts:

The revamped Amazon Pay ICICI Bank credit card sets a new benchmark for co-branded financial products in India. Packed with unlimited cashback, zero fees, low forex charges, and rewarding travel benefits, it’s designed to be both your everyday companion and a trusted global travel partner.

Offering a rare advantage of a lifetime free credit card, it delivers unmatched value across shopping, travel, and international spends, all with complete transparency.