In early 2025, Ravi, a small business owner from Pune, received a WhatsApp message that looked harmless. It said his bank account required a “mandatory KYC update” and included a file named Update.apk. The logo looked official. The message sounded urgent. Within minutes of installing the file, his phone went silent. OTPs stopped arriving. By the evening, ₹1.8 lakh had vanished from his bank account.

Ravi’s story is not unique. Across India, thousands of users are falling victim to APK-based scams, a fast growing form of mobile cyber fraud that exploits trust, urgency, and lack of awareness.

This guide explains how APK scams work, how to identify if your phone is hacked, what immediate steps to take, and how to recover money if fraud has already happened.

What Is an APK Scam and Why It Is Spreading in India

An APK (Android Package Kit) is the file format used to install apps on Android devices. Unlike apps downloaded from the Google Play Store, APK files can be installed manually. Scammers misuse this feature to distribute malicious apps disguised as bank updates, government alerts, e-challans, wedding invitations, or festive greetings.

India has become a major target because:

- Android dominates the smartphone market

- UPI and mobile banking usage is extremely high

- WhatsApp is widely used for daily communication

- Many users are unaware of the risks of installing APKs from messages

Indian Express, Times of India, and Economic Times have repeatedly reported cases where fake APKs sent on WhatsApp drained bank accounts within minutes, often without victims sharing OTPs.

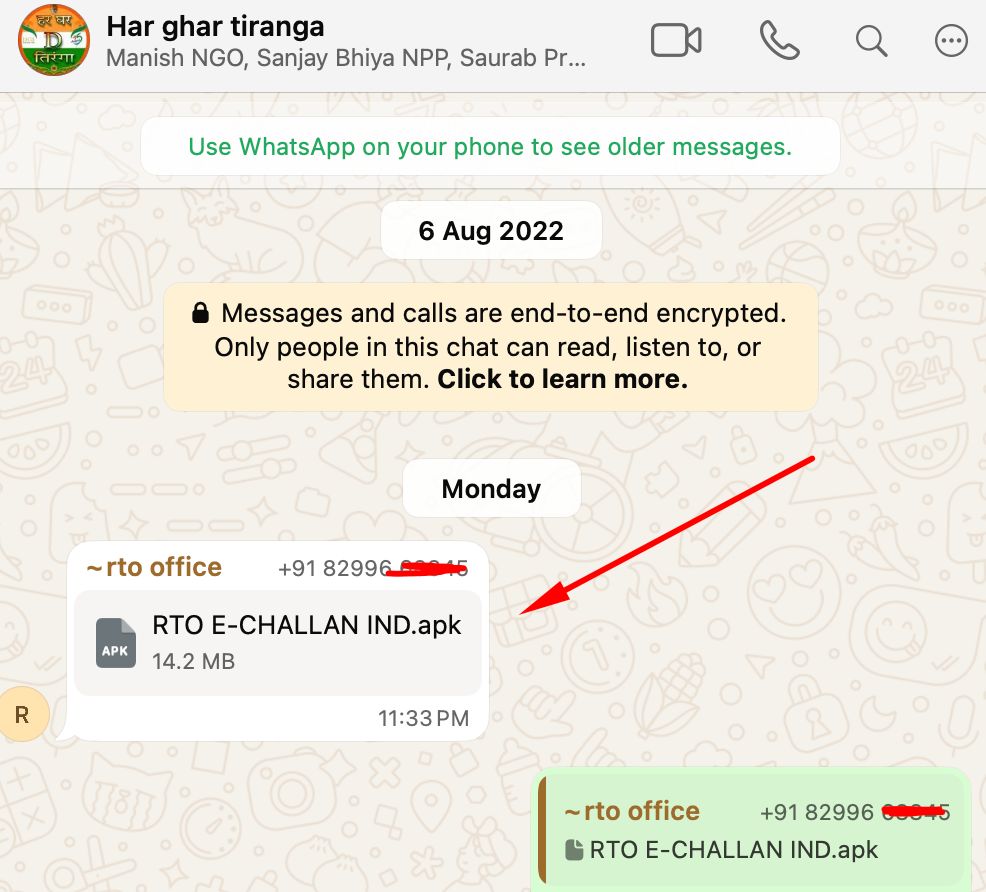

How APK Scam Messages Usually Look (Real-World Pattern)

APK scams rely on social engineering, not technical hacking. The message is designed to trigger fear or excitement.These days fraudster are very smart they keep searching methods to fool normal people for that reasons they send below messages .

Common formats include:

- “Your bank account will be blocked today. Install update now.”

- “Pending traffic challan – download receipt.”

- “Wedding invitation.apk”

- “New Year greeting – special video”

- “SBI / YONO / KYC update required”

These messages usually:

- Come from unknown numbers

- Use urgency or authority

- Ask you to install an app outside Play Store

- Instruct you to enable “Install from unknown sources”

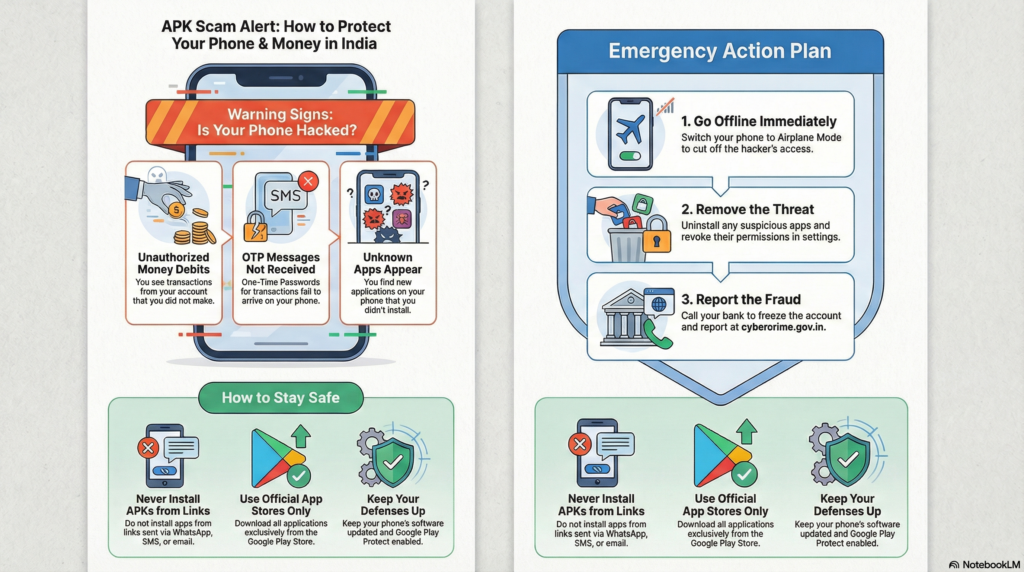

How to Identify If Your Phone Is Hacked by an APK Scam

Early Warning Signs You Should Never Ignore. Yes sometimes our phone is infected and we even do’t know that and when hacker knows your phone infected they start attacking phones with their installed software’s that’s why we are giving some early sign which you keep tracking.

If your phone shows any of the following, assume compromise:

- Money debited without your action

- OTPs not reaching your phone

- Phone becomes slow, hot, or battery drains rapidly

- Unknown apps appear in installed apps list

- Screen moves or apps open automatically

- SMS sent from your phone without your consent

Many APK malware variants secretly gain Accessibility permissions, allowing attackers to read screens, capture keystrokes, and approve transactions silently.

Manual Check to See Phone Is Hacked or Infected (2-Minute Test)

To prevent your phone for such APK hacks , time to time please check your phone setting with below given methods.

Go to your Phone apps:

Settings → Apps → Installed Apps → Sort by “Recently Installed”

Red flags:

- Apps with generic names like System Update, Service, Helper

- Apps without icons

- Apps you don’t remember installing

Then check:

Settings → Privacy → Permission Manager

If an unknown app has access to:

- SMS

- Accessibility

- Device Admin

- Screen recording

Your phone is compromised.

If you see your phone is hack immediate uninstall that app from Installed APPS and still you are not sure what to do please follow our guide for complete solutions.

Immediate Emergency Measures To Prevent From Financial APK Fraud (First 10 Minutes Matter)

This stage is critical. Speed determines damage.

Some how you installed unknown’s APK file and your money is lost or you do’t know what to do at that time. You just need to follow our instructions to save your valuable data & money .

Step 1: Isolate the Phone Immediately

- Turn on Airplane Mode

- Disable Wi-Fi, Mobile Data, Bluetooth

- Do not open bank or UPI apps

This prevents the malware from communicating with the attacker.

Step 2: Remove the Malicious App

- Go to Settings → Security → Device Admin Apps

(If you did not find the options simply search in setting search box) - Disable the unknown app

- Go to Settings → Apps → Uninstall

If uninstall is blocked, do not panic proceed to a factory reset later.

Step 3: Revoke Dangerous Permissions

- Remove SMS, Accessibility, and Screen access from unknown apps

- Re-enable Google Play Protect

What to Do If Money Is Already Debited (Golden Hour Recovery)

This is where most victims lose time and money.

Cyber attack is successful and hacker stole your money and transfer it another UPI account or bank account then you have potential chance to recover it if you act smartly and fast.

Step 1: Call Your Bank or UPI App Immediately

NPCI‘s (UPI) Toll Free number is 1800-120-1740 this call and explain your problem, you can also call your bank account toll free numbers also. When Call is connected

Ask them to:

- Freeze your account

- Stop pending settlements

- Raise a fraud ticket

The first 30–60 minutes (Golden Hour) is crucial. Many recoveries reported by Times of India succeeded because victims acted quickly.

Step 2: File an Online Complaint on Cyber Crime Portal

Visit cybercrime.gov.in and select:

Financial Fraud → UPI / Banking Fraud

Or

Call 1930 of Indian Cybercrime gov portal toll free number to raise a complain.

Submit:

- Transaction ID

- Amount & date

- Bank / UPI app name

- Mobile number

This triggers:

- Inter-bank fund tracing

- Freezing of mule accounts

- Legal documentation for recovery

Save the acknowledgement number.

Step 3: Secure All Accounts (From Another Device)

Change passwords for:

- Bank apps

- UPI apps

- Email (most important)

- Google account

Reset:

- UPI PIN

- Net banking credentials

Enable two-factor authentication everywhere.

When and Why You Should Factory Reset Your Phone

We have taught you how you can prevent & report cyber crime fraud and be safe for such unfortunate events but if you still doubtful that your phone is free form that APK or not . Then their is ultimate solution is to Format or Reset the phone.

You can use this steps when ..

- Phone still behaves abnormally

- Uninstall fails

- You’re unsure which app caused the issue

Do a factory reset.

Before reset:

- Backup only photos and contacts

- Do NOT back up apps

After reset:

- Update Android OS

- Install apps only from Play Store

- Never restore unknown apps

Cybercrime units often recommend this as the safest final step.

What NOT to Do (Common Mistakes)

- Do not install “refund” or “recovery” APKs

- Do not trust callers claiming to be police or bank asking for OTP

- Do not delay reporting

- Do not assume “small amount loss” means no further risk

Many second-stage scams target victims again.

How to Prevent APK Scams in the Future

Follow these rules strictly:

- Never install APK files from WhatsApp or SMS

- Keep “Install unknown apps” disabled

- Enable Google Play Protect

- Keep phone and apps updated

- Educate family members, especially elderly users

- Treat urgency messages as suspicious by default

One simple rule protects you:

No bank or government body sends APK files on WhatsApp.

Final Thoughts: Awareness Is Your First Antivirus

APK scams do not hack phones using advanced technology. They exploit trust, urgency, and lack of awareness. Once you understand how they work, they lose power.

If Ravi had paused for 10 seconds before installing that APK, his story would have ended differently. Your awareness can ensure yours does.