Do you want to find the best prediction market sites in 2025?

You are in the right place.

Because this guide is not just a list.

It is a complete breakdown of the platforms that are changing the way we see the future.

We are going to cover everything from the “Big Three” in the US (Kalshi, Polymarket, PredictIt) to the rise and fall of opinion trading giants in India like Probo.

But I am not stopping there.

I am also going to show you:

- How to choose the right platform for your specific trading style.

- The hidden fees that eat into your profits (and how to avoid them).

- Advanced trading strategies used by the pros.

So, if you are ready to turn your opinions into potential profits, let’s dive right in.

The Explosion of Prediction Markets

Prediction markets are having a moment.

In fact, “moment” might be an understatement.

They are exploding.

Trading volumes on platforms like Polymarket and Kalshi hit billions of dollars in 2025.

Why the sudden surge?

It comes down to three big changes.

1. The “Legal” Switch Flipped

For years, trading on political events in the US was a gray area. Or worse. It was illegal.

But that changed in late 2024.

Kalshi, a US-based exchange, won a landmark lawsuit against the Commodity Futures Trading Commission (CFTC).

This was huge.

It effectively legalized election betting for regulated exchanges.

2. Crypto Solved the Liquidity Problem

Old prediction markets were slow.

They were hard to fund.

Polymarket changed the game.

By building on the Polygon blockchain and using USDC (a stablecoin), they created a global, borderless pool of money.

Suddenly, a trader in London could bet against a trader in Tokyo on the outcome of the US election. Instantly.

3. The “Truth” Premium

We live in an era of fake news.

Polls are unreliable. Pundits are biased.

People realized that prediction markets offer something better: Skin in the game.

When people bet real money, they stop posturing. They start thinking.

As a result, these markets often predict outcomes—from election results to interest rate hikes—more accurately than the “experts.”

But here is the catch.

Not all prediction markets are safe.

Some are regulated. Some are the “Wild West.” And some, as we will see with Probo, can disappear overnight.

In this chapter, we will break down exactly what makes a prediction market tick and why 2025 is the year they went mainstream.

How Opinion Market It Works?

At its heart, a prediction market is simple.

It is a stock market for events.

Instead of buying a share of Apple or Tesla, you buy a share of an outcome.

The “Yes” and “No” Contract

Let’s say the event is: “Will the Fed cut interest rates in December?”

There are two contracts:

- Yes

- No

The price of a contract is always between $0.00 and $1.00 (or $0 to $100, depending on the platform).

The price represents the probability of the event happening.

Example:

If the “Yes” contract is trading at $0.60, the market believes there is a 60% chance the Fed will cut rates.

If you buy the “Yes” contract and the Fed does cut rates, the contract pays out $1.00.

Your profit?

$1.00 (Payout) – $0.60 (Cost) = $0.40 Profit.

If the Fed does not cut rates, the contract goes to $0.00. You lose your $0.60.

It is binary. It is brutal. And it is incredibly efficient.

Types of Prediction Market Platforms

Before you deposit a single cent, you need to understand the two main types of platforms.

1. The Centralized Exchange (The “Bank” Model)

Think of this like a traditional stock brokerage.

- Examples: Kalshi, PredictIt, ForecastEx.

- How it works: You send them money via bank transfer. They hold your funds. They match your trades on a central computer.

- Pros: Regulated, safe, easy to use if you have a bank account.

- Cons: Strict KYC (Know Your Customer), higher fees, geographic restrictions.

2. The Decentralized Exchange (The “Crypto” Model)

Think of this like a peer-to-peer network.

- Examples: Polymarket, Zeitgeist.

- How it works: You connect a crypto wallet. You hold your own funds. Smart contracts on a blockchain match the trades.

- Pros: Global access, lower fees, censorship-resistant.

- Cons: Technical learning curve, “smart contract risk” (bugs in the code).

Which one is right for you?

That depends on who you are.

If you are a US institution managing millions, you want the Centralized model.

If you are a crypto-native trader looking for the best odds on a niche topic, you want the Decentralized model.

We will break down the pros and cons of each in the coming chapters.

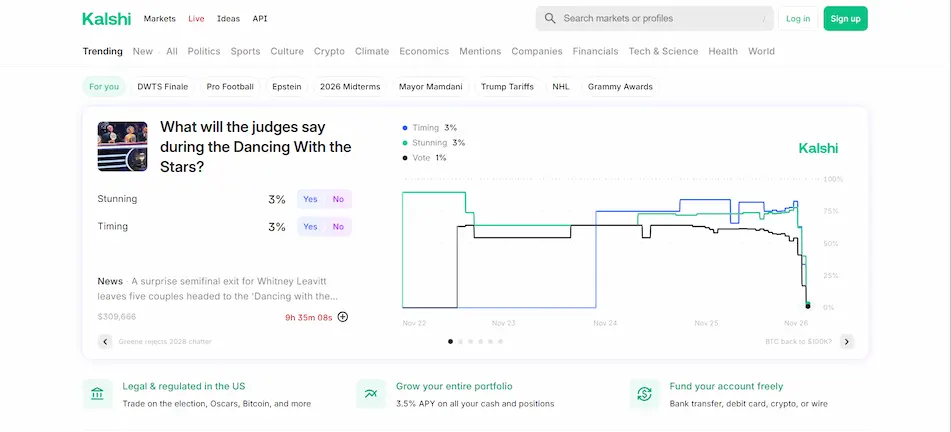

1. Kalshi

If you are in the US, Kalshi is the name to know.

It is the first federally regulated exchange dedicated to event contracts.

Basically, it is the New York Stock Exchange of prediction markets.

What makes Kalshi special?

One word: Trust.

Kalshi is regulated by the CFTC (Commodity Futures Trading Commission).

This is a big deal.

It means:

- Segregated Funds: Your money is kept separate from the company’s money. If Kalshi goes bankrupt, your funds are safe.

- Legal Clarity: You are not breaking any laws by trading here.

- No “Rug Pulls”: The exchange is audited and monitored by the federal government.

For years, this regulation was a double-edged sword.

It made Kalshi safe. But it also made them boring.

The CFTC would not let them list “fun” markets like elections.

But that changed in 2024.

Kalshi sued the CFTC. And they won.

Now, Kalshi offers contracts on US elections, policy outcomes, and more. They have combined the safety of a bank with the excitement of a betting site.

How is the User Experience of this Platform?

Kalshi is built for the mainstream.

You don’t need to know what a “private key” or a “blockchain” is.

Getting Started:

- Sign Up: Enter your email and basic info.

- Verify: Since it is regulated, you must provide your Social Security Number (SSN) for identity verification.

- Deposit: Link your bank account (ACH) or use a debit card.

The interface is clean. It looks like Robinhood or E-Trade.

Markets are organized into clear categories:

- Economics: Fed rates, GDP, Inflation.

- Politics: Elections, Bills passing.

- Weather: Temperature highs, Hurricanes.

- Science: NASA launches, COVID cases.

Feature Spotlight: The Mobile App

Kalshi has a fantastic mobile app. It is fast, intuitive, and allows you to trade on the go. This is a major advantage over some competitors that rely on clunky mobile websites.

Charges and Fees

Kalshi’s fees can be tricky.

They don’t charge a flat percentage like a crypto exchange.

Instead, they use a variable fee structure based on the price of the contract and the number of contracts.

The Formula:

Fee = Round Up (0.07 x Contracts x Price x (1 – Price)).

Let’s translate that into English.

The fee is highest when the odds are close to 50/50.

It is lowest when the odds are extreme (e.g., 99% or 1%).

Why do they do this?

It is designed to encourage trading on “sure things” by making it cheaper.

The “Maker” Rebate

Kalshi also differentiates between “Makers” and “Takers.”

- Taker: You buy an order that is already on the book. You pay the standard fee.

- Maker: You place a new order that sits on the book. You pay a lower fee (around 1%).

Deposit and Withdrawal Fees:

- ACH: Free.

- Debit Card: 2% fee.

- Withdrawal: $2.00 fee for standard transfers.

The Bottom Line on Fees:

Kalshi is more expensive than Polymarket (which we will cover next). But you are paying for the safety of regulation and the convenience of bank transfers.

Liquidity and Limits

Liquidity is crucial.

If you want to bet $10,000, you need someone on the other side to take that bet.

Kalshi’s liquidity has grown massively since the election ban was lifted.

Institutional market makers (big trading firms) provide millions of dollars in liquidity.

Position Limits:

Because it is regulated, there are limits on how much you can bet.

For most retail traders, the limit is high enough (often $25,000+ per market).

However, if you are a “whale,” you might hit a ceiling.

Is Kalshi Right For You?

YES if:

- You live in the US.

- You want your money to be federally insured/protected.

- You prefer using bank transfers over crypto.

- You want to bet on “boring” but profitable markets like inflation data.

NO if:

- You are outside the US.

- You are a high-frequency trader who needs rock-bottom fees.

- You want to bet on niche, unregulated topics.

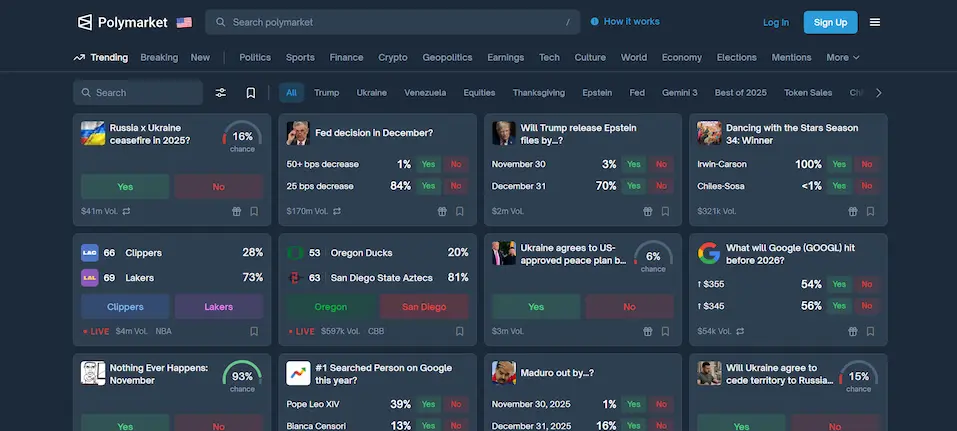

2. Polymarket

If Kalshi is the safe, buttoned-up banker…

Polymarket is the cool, tech-savvy disrupter.

It is the world’s largest prediction market by volume.

And it runs entirely on the blockchain.

Polymarket does not hold your money.

It is a “Non-Custodial” platform.

You connect your own crypto wallet (like MetaMask or Phantom). You deposit USDC (a digital dollar).

The trades are executed by smart contracts on the Polygon blockchain.

Why does this matter?

- No Accounts: You don’t need to send them your ID or passport (for the global version).

- Global Access: Anyone with an internet connection can trade.

- Censorship Resistance: No single person can easily shut down a market once it is live.

Past Controversy regarding this Platform

For years, Polymarket had a problem.

The US government hated it.

In 2022, the CFTC fined them and forced them to block US users.

But Polymarket played the long game.

In 2025, they acquired QCEX, a CFTC-licensed exchange.

This was a masterstroke.

It allows Polymarket to launch a fully compliant, regulated version for US users.

This means American traders can finally access Polymarket’s deep liquidity without using a VPN (which was always risky).

How is the User Experience of this Platform?

Polymarket’s interface is slick.

It looks like a modern news site.

The homepage is a dashboard of the world’s most pressing questions:

- “Who will win the election?”

- “Will Bitcoin hit $100k?”

- “Will the government ban TikTok?”

The Learning Curve:

If you are already into crypto, it is seamless.

If you are a “No-Coiner” (someone who has never used crypto), it can be intimidating.

You need to:

- Buy USDC on an exchange (like Coinbase).

- Send it to your Polygon wallet.

- Connect the wallet to Polymarket.

However, Polymarket has worked hard to solve this.

They integrated MoonPay and Robinhood Connect.

Now, you can buy USDC directly on the site using a credit card. It removes much of the friction.

Charges and Fees

This is Polymarket’s “Killer App.”

The fees are incredibly low.

For the new US exchange, the fee is just 0.01%.

Let’s compare that to Kalshi.

Trade Size: $100

- Kalshi Fee: ~$1.20 (approx 1.2%).

- Polymarket Fee: $0.01.

It is not even close.

For high-volume traders, this difference is the difference between being profitable and losing money.

Market Variety

Polymarket bets on everything.

Because it started as an unregulated, decentralized platform, it has a culture of “anything goes.”

You will find markets here that you won’t find on Kalshi:

- Geopolitics: War outcomes, coup attempts, international treaties.

- Crypto: detailed markets on Ethereum upgrades, Solana prices, NFT floor prices.

- Tech: CEO firings, AI milestones.

- Pop Culture: Viral internet trends.

Liquidity Depth:

Polymarket has the deepest liquidity in the world for major events.

During the election cycle, hundreds of millions of dollars flow through its contracts.

This means you can enter and exit large positions without moving the price too much (low slippage).

Is Polymarket Right For You?

YES if:

- You want the best odds and lowest fees.

- You are comfortable with (or willing to learn) basic crypto concepts.

- You want to bet on global events, not just US-centric ones.

- You trade large volumes.

NO if:

- You are terrified of crypto wallets.

- You want the absolute safety of a federally insured bank transfer.

3. PredictIt

Before Kalshi. Before Polymarket.

There was PredictIt.

Launched in 2014, PredictIt is a project of Victoria University of Wellington in New Zealand.

It operates under a “No-Action” letter from the CFTC. This essentially gave it a “Get out of Jail Free” card to operate as an academic experiment.

For a decade, it was the only game in town for US political betting.

But in 2025, it is showing its age.

Because it is technically a “research project,” the government put strict limits on it.

1. The 850-Trader Limit

Only 850 people could trade in a single contract. (This was later relaxed, but limits remain).

2. The $850 Investment Cap

You cannot invest more than $850 in a single contract.

This is a huge problem.

It means “Whales” (smart money) cannot correct the market.

If a market is irrationally priced, a smart trader can only bet $850 to fix it. That is often not enough to move the needle.

3. The Fees

PredictIt’s fees are painful.

- 10% on Profits: If you make $100, they take $10.

- 5% on Withdrawals: If you take your money out, they take another 5%.

This makes it very hard to be a profitable long-term trader.

Why Do People Still Use It?

So, high fees and strict limits. Why is it still around?

The “Dumb Money” Opportunity.

Because smart money is capped at $850, the markets are often inefficient.

They are driven by emotion, not data.

If you are a smart trader, you can find massive arbitrage opportunities.

You can bet against the “fanboys” who are betting with their hearts instead of their heads.

The Community:

PredictIt has a very active comment section. It is like a social network for political junkies.

The data from PredictIt is also widely cited by mainstream media (CNN, MSNBC) because it has been around so long.

Is PredictIt Right For You?

YES if:

- You are a casual hobbyist.

- You want to bet small amounts ($50-$100) on politics.

- You enjoy reading the comments and being part of a community.

- You are looking for “soft” markets where you can beat less sophisticated traders.

NO if:

- You want to make serious money (the fees and caps will stop you).

- You want to bet on anything other than US politics.

4. Probo

Now, let’s shift gears.

Let’s talk about Probo.

If you are in India, you know Probo.

It was the darling of the Indian startup scene.

It brought “Opinion Trading” to the masses.

But in late 2025, everything crashed.

The Rise of Probo

Probo’s pitch was brilliant.

“Don’t just watch the news. Trade on it.”

It allowed users to trade on:

- Cricket: “Will India win the match?”

- Bollywood: “Will ‘Pathaan 2’ cross 500 Crores?”

- News: “Will it rain in Delhi tomorrow?”

It was addictive. It was fast. And it was huge.

Millions of users signed up.

The “Skill” vs. “Chance” Debate

In India, gambling is largely illegal.

But “Games of Skill” are legal.

Probo argued that prediction markets are Games of Skill.

They said: “You need knowledge to predict the weather or a cricket match. It is not just luck.”

They pointed to the US. “Look at Kalshi! Look at the US stock market! This is finance, not gambling”.

But the Indian government didn’t buy it.

The 2025 Ban

In late 2025, the Indian Parliament passed the Online Gaming Bill.

It was a blanket ban on “Real Money Gaming” (RMG).

It erased the line between skill and chance. If you were wagering money on an outcome, it was banned.

The Impact:

- Probo Halted: The app stopped accepting trades.

- Dream11 Impacted: Fantasy sports took a massive hit.

- Deposits Frozen: Users could no longer add money.

The Current Status (November 2025)

If you open the Probo app today, you will likely see a message:

“In light of recent developments, we have stopped all money gaming operations.”.

What if you have money in Probo?

Withdraw it. Now.

The company has promised to honor withdrawals, but regulatory crackdowns can lead to frozen bank accounts. Do not wait.

Alternatives for Indian Users

So, what now?

If you are in India and want to trade opinions, your options are limited.

1. Offshore Crypto (Polymarket):

The government banned bank transfers to betting sites. But they cannot easily ban crypto.

Many Indian traders are moving to Polymarket.

- How: Buy USDC on a P2P exchange (like Binance P2P) and transfer it to a wallet.

- Risk: The government is cracking down on crypto on-ramps. It is risky.

2. Stock Market Options (NSE/BSE):

The only legal “prediction market” left is the stock market.

Trading options on the Nifty 50 or Bank Nifty is essentially betting on the future direction of the economy. It is regulated, legal, and liquid.

3. Social Markets (Manifold):

If you just want the fun of predicting without the money risk, Manifold is a great option. It uses play money. It is legal everywhere.

The Lesson of Probo:

Regulatory risk is real.

When choosing a platform, you are not just betting on the event. You are betting on the platform being allowed to exist like Casino Days live dealer games.

5. Robinhood

Yes, that Robinhood.

The app that democratized stock trading is now coming for prediction markets.

The Strategy:

Robinhood is rolling out event contracts to its millions of existing users.

They are starting slow. Mostly contracts on the Federal Reserve and economic data.

Why it’s a threat:

- User Base: They have millions of users already verified and funded.

- UX: Their app is the gold standard for ease of use.

- Fees: Robinhood loves “commission-free” models (though they make money on the spread).

If Robinhood decides to list political markets, they could become the biggest player overnight.

6. Interactive Brokers (ForecastEx)

Interactive Brokers (IBKR) is for the pros.

They launched ForecastEx.

The Target:

Hedge funds and professional traders who want to hedge risk.

Example: An airline wants to hedge against the risk of a bad hurricane season. They can buy “Yes” contracts on hurricane landings.

The Verdict:

It is not “fun.” You won’t find bets on Taylor Swift here. But for serious financial hedging, it is a powerful tool.

7. Manifold (The Social Player)

Manifold is unique.

It uses “Mana” (a play currency).

Why use it?

- Create Your Own: You can create a market on anything. “Will I finish this blog post by Friday?”

- Calibrate Your Brain: It is the best place to practice thinking in probabilities without losing your life savings.

- Prizes: In 2025, they started experimenting with a “Sweepstakes” model to offer real prizes legally.

Comparison

Still not sure which one to pick?

Here is the deal.

Use this table to find your match.

| Feature | Kalshi | Polymarket | PredictIt |

| Best For… | US Residents seeking safety | Volume traders & Crypto natives | Political hobbyists |

| Regulation | High (CFTC) | Hybrid (Offshore/QCEX) | Low (Academic Exemption) |

| Fees | ~2% (Variable) | ~0.01% (Low) | 10% on Profits + 5% Withdrawal |

| Deposit Method | Bank Transfer / Card | USDC (Crypto) | Bank Transfer / Card |

| Speed | Fast | Lightning Fast | Slow |

| Market Variety | Economics, Politics, Weather | Everything (Global) | US Politics Only |

| Max Bet | $7M+ (Institutions) | Unlimited | $850 |

Our Recommendation

- For the Average American: Start with Kalshi. It is safe, easy, and legal.

- For the Pro Trader: Go to Polymarket. The liquidity and low fees are unbeatable.

- For the Political Junkie: Keep an eye on PredictIt for sentiment analysis, but place your big bets on Polymarket or Kalshi.

Advanced Trading Strategies

You have picked a site. You have deposited money.

Now, how do you win?

Most people lose money in prediction markets.

They treat it like a slot machine.

Here is how to treat it like a job.

Strategy 1: Arbitrage

Prediction markets are fragmented.

Kalshi might price a “Yes” at $0.60.

Polymarket might price the same “Yes” at $0.65.

The Trade:

- Buy “Yes” on Kalshi for $0.60.

- Buy “No” on Polymarket for $0.35 (since “Yes” is $0.65, “No” is $1.00 – $0.65 = $0.35).

- Total Cost: $0.95.

- Payout: $1.00 (No matter who wins, one contract pays out).

- Profit: $0.05 per share. Risk-free.

The Catch:

Fees. You need to make sure the profit margin is higher than the fees on both platforms.

Strategy 2: News Trading

Prediction markets are fast. But they are not instant.

There is a lag between “Breaking News” and the price moving.

The Trade:

- Set up fast news alerts (Twitter/X, Bloomberg Terminal).

- When news breaks (e.g., “Fed Chair hints at rate cut”), buy the corresponding contract immediately.

- Sell it 10 minutes later when the rest of the market catches up.

Strategy 3: The “Polymarket Whale” Watch

On the blockchain, everything is public.

You can see when a “Whale” (a massive trader) buys a position.

The Trade:

- Monitor the big wallets on Polymarket.

- If a smart whale (someone with a high win rate) makes a big bet, follow them.

- It is called “Copy Trading.”

Conclusion

We have covered a lot.

The regulated safety of Kalshi.

The global power of Polymarket.

The quirky history of PredictIt.

And the tragic fall of Probo.

The world of prediction markets is exciting. It is lucrative. And it is dangerous.

But one thing is clear.

It is not going away.

We are moving from an age of “Expert Opinions” to an age of “Market Probabilities.”

The question is not if you will use a prediction market.

It is when.

Now It’s Your Turn.

Which platform are you going to try first?

Are you going to stick with the safety of Kalshi?

Or are you ready to dive into the deep end with Polymarket?

Let me know.

Because in this market, your opinion is the only asset that matters.

(Disclaimer: Trading in prediction markets involves significant risk. You can lose your entire investment. This guide is for educational purposes only and is not financial advice.)