TL;DR / Key Insights

- NPCI’s UPI Help Portal (upihelp.npci.org.in) works as a network-level authority above Google Pay, PhonePe, Paytm, and banks

- Most failed UPI transactions auto-refund within 24 to 72 hours under RBI-aligned UDIR rules

- UPI AutoPay subscriptions can be audited, paused, or cancelled in under 2 minutes

- UPI PIN is never needed to view data, only to approve mandate changes or financial actions

- Many users unknowingly lose ₹500 to ₹5,000 per year to forgotten subscriptions

When a UPI payment fails or hangs in “processing,” people usually chase app support or bank helplines. The experience often feels slow, fragmented, and uncertain. A similar frustration builds with recurring subscriptions. Small monthly debits keep happening quietly, sometimes for services long forgotten.

The NPCI UPI Help Portal changes this structure. Instead of depending on Third Party App Providers (TPAPs) such as Google Pay, PhonePe, or Paytm, it operates at the UPI network layer, governed by NPCI under RBI’s payment systems oversight.

It functions as both:

- A central grievance redressal system for UPI disputes

- A unified control panel for UPI AutoPay mandates across apps and banks

Transaction records are fetched from PSP banks, the UPI mapper, and NPCI infrastructure, giving it broader authority than individual app support teams.

This guide focuses on two practical powers:

- Faster UPI dispute resolution through UDIR

- Full control over recurring UPI AutoPay mandates, including subscription cancellation

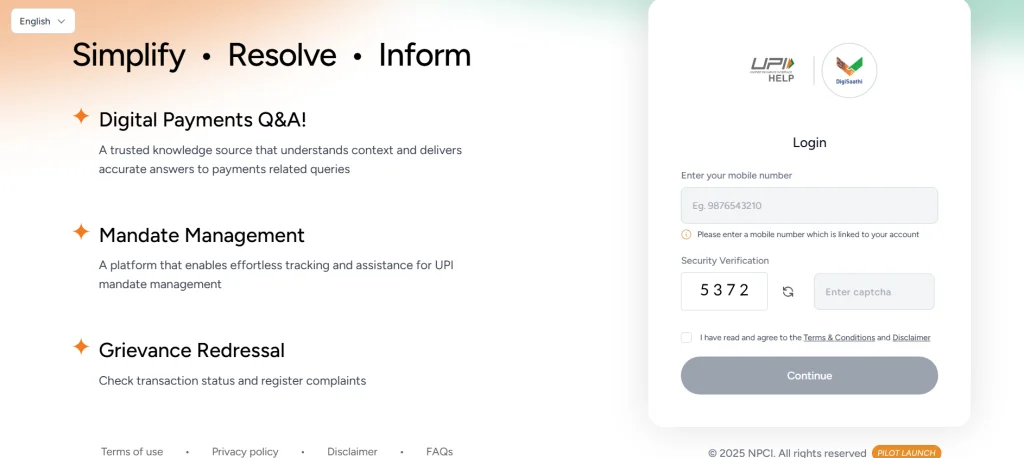

How to Get Started with UPI Help NPCI Portal?

Access uses a mobile number + OTP model. No passwords are stored, reducing exposure to account takeovers.

Required:

- UPI-linked mobile number

- One-time password via SMS

No wallet profile or permanent account is created.

When the UPI PIN Is Actually Required?

PIN is never needed to:

- Log in

- View transactions

- Track disputes

- See AutoPay mandates

PIN is only required to:

- Revoke or pause a mandate

- Approve a financial change

- Confirm bank-routed actions

Any site asking for PIN just to display information should be treated as suspicious.

Why the Portal Is Legitimate?

The portal functions as a gateway to UPI core systems, not a payment wallet. It follows NPCI dispute protocols and RBI grievance timelines, aligning with formal banking SLAs rather than app-level policies.

It does not store complete financial records locally. Most sensitive data stays within regulated banking systems.

Feature 1: The “Kill Switch” for UPI AutoPay (Mandate Management)

UPI AutoPay powers OTT subscriptions, loan EMIs, SaaS tools, coaching fees, insurance renewals, delivery services, and utility payments. Mandates are easy to approve, but often scattered across apps, making tracking difficult.

Over time, unused subscriptions turn into silent financial leakage.

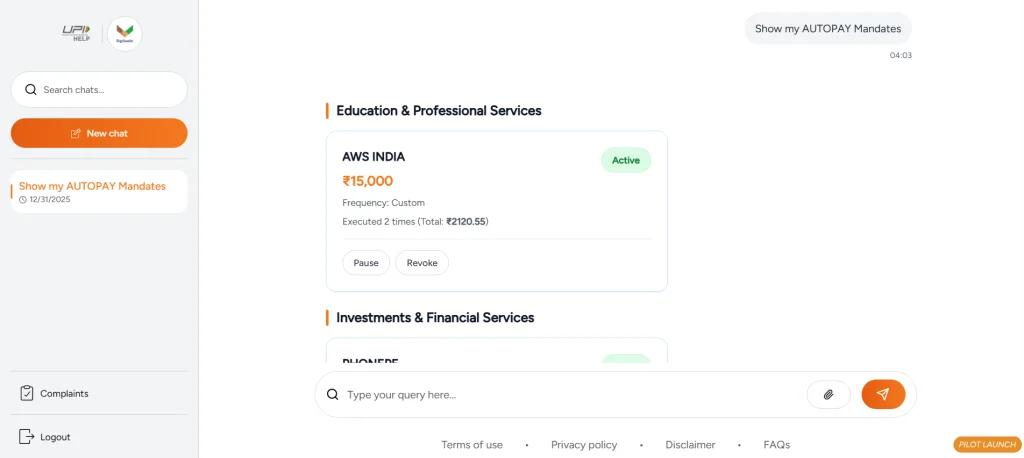

One Dashboard for All UPI Mandates

The portal lists all UPI AutoPay mandates in one place, including those created via:

- Google Pay

- PhonePe

- Paytm

- Bank apps

- Merchant checkout pages

This eliminates the need to search across multiple apps.

How to Cancel or Pause a UPI AutoPay Mandate

Steps:

- Log in using mobile number and OTP

- Choose “Show my AUTOPAY Mandates” or type in the chat box.

- Select the mandate

- Click Revoke or Pause

- Confirm with UPI PIN

Revocation stops future debits. Pause temporarily suspends payments.

Mandate Status Meanings

| Mandate Status | Meaning | Action |

|---|---|---|

| Active | Auto-debits enabled | Revoke or Pause |

| Paused | Temporarily stopped | Resume when needed |

| Expired | Mandate validity ended | Renew if required |

| Revoked | Permanently cancelled | No further action |

Used For –

- Cancelling unused OTT subscriptions

- Stopping trial subscriptions before billing

- Ending EMI AutoPay after loan closure

- Pausing milk or gym subscriptions during travel

- Blocking recurring gaming or SaaS charges

A salaried employee on Linkedin recently shared that while auditing mandates recently, they found ₹1,200 per month deducted across three forgotten services.

Mandate Portability (90-Day Rule)

Mandate portability allows users to shift recurring mandates between apps without re-authorising payments.

Key points:

- Mandates remain portable for up to 90 days

- Useful when switching TPAPs

- Prevents disruption to rent, EMI, or insurance mandates

This feature reduces dependency on a single payment app.

Feature 2: UPI Dispute Resolution via UDIR

Why Refunds Used to Take Days?

Earlier UPI dispute resolution relied on manual file exchanges between banks and apps. This created long back-and-forth cycles and unclear accountability.

And what does UDIR Changes?

UDIR (Unified Dispute & Issue Resolution) replaces file workflows with real-time API-based communication between NPCI and PSP banks.

Old system: Manual files, email escalations

New system: Automated validation, real-time sync

Many failed transactions now reverse automatically without user complaints.

How to Track a Failed or Pending Transaction

Search options include:

- UTR (Unique Transaction Reference)

- Date and amount

- Sender or receiver VPA

- Bank reference ID

This helps locate transactions even when app history appears incomplete.

Common Transaction Status Meanings

| Status | Meaning |

|---|---|

| Failed | Refund expected automatically |

| Pending | Awaiting bank confirmation |

| Deemed Approved | Likely successful despite app delay |

| Reversed | Refund completed |

| Disputed | Under UDIR review |

Refund Timelines by Failure Type

| Failure Type | Typical Timeline |

|---|---|

| Technical failure | 24 to 72 hours |

| Bank server downtime | Up to 3 working days |

| Duplicate debit | 1 to 3 working days |

| Merchant processing error | 3 to 7 working days |

| Merchant dispute / chargeback | Depends on merchant SLA |

| Wrong beneficiary transfer | Manual recovery process |

These align with RBI’s T+1, T+3, and T+7 operational SLA windows depending on dispute type.

Chargeback vs Reversal vs Refund

| Term | Meaning |

|---|---|

| Reversal | Auto-return after technical failure |

| Refund | Merchant-approved return |

| Chargeback | Formal dispute against merchant |

Not all failed transactions qualify for chargebacks. Technical failures usually result in reversals.

Automated Reversal Logic

Roughly 80–90 percent of technical failures reverse automatically. Manual complaints are typically needed for:

- Merchant disagreements

- Fraud or scam reports

- Wrong beneficiary transfers

UPI Error Code Library

| Error Code | Meaning | What to Do |

|---|---|---|

| U30 | Bank system down | Wait 30 minutes |

| Z9 | Insufficient funds | Add balance |

| U19 | Daily limit reached | Retry after 24 hours |

| U28 | Timeout | Check status before retry |

| U16 | PIN failures | Reset PIN |

| U01 | Invalid beneficiary | Verify VPA |

| U07 | Duplicate transaction | Avoid retry |

| U54 | Merchant server error | Retry later |

| Deemed Approved | Conditional success | Wait for completion |

This captures long-tail search intent often missed by generic guides.

NPCI vs App vs Bank Support: Who Resolves Faster?

| Support Layer | Speed | Authority | Coverage |

|---|---|---|---|

| Payment App Support | Medium to slow | App-limited | App only |

| Bank Customer Care | Medium | Bank-limited | Account-level |

| NPCI UPI Help Portal | Faster for technical issues | Network-level | Cross-bank & cross-app |

This explains why portal-based disputes often resolve quicker.

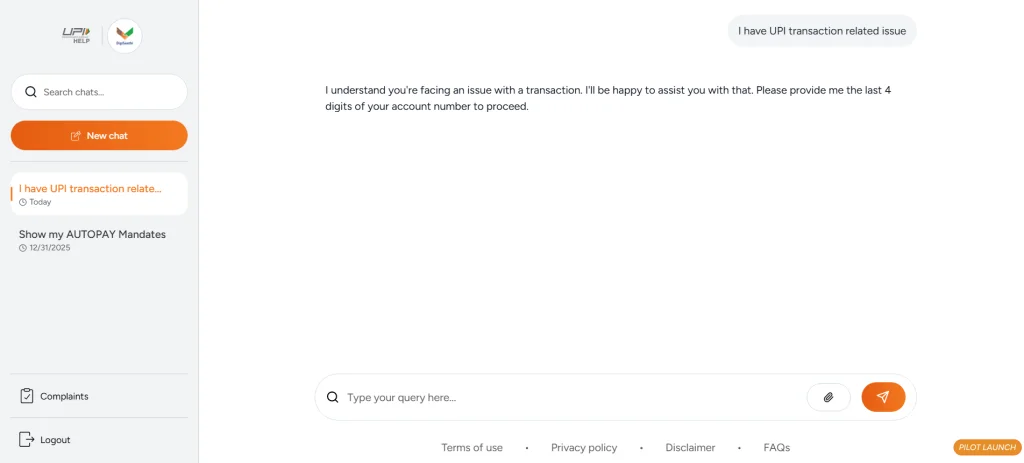

About UPI Help NPCI Chat Bot

NPCI’s AI assistant functions as an action-driven bot, not a generic chatbot.

- Explains error codes in plain language

- Guides mandate cancellation

- Deep-links to app AutoPay settings

- Surfaces dispute status

- Redirects to bank or merchant escalation paths

This reduces dependency on slow app menus and helplines.

One Local Seller Shared their Experience

A local seller in Bhopal reported a ₹12,450 UPI debit marked pending after a customer payment failed. Using the NPCI portal, the transaction was verified under UDIR and auto-reversed within 48 hours, without raising a ticket inside the payment app.

Another example involves a government exam aspirant recovering a ₹500 duplicate exam fee payment, reversed within three days after appearing as a failed debit.

Key UPI & NPCI Terms

| Term | Meaning |

|---|---|

| NPCI | National Payments Corporation of India |

| TPAP | Third Party App Provider (Google Pay, PhonePe) |

| PSP Bank | Bank providing UPI payment services |

| UDIR | Unified Dispute & Issue Resolution |

| Mandate | Authorised recurring UPI payment |

| SLA | Service Level Agreement timeline |

| UTR | Unique Transaction Reference |

FAQ

- Question: Can IPO UPI mandates be managed here?

Answer: Yes. IPO ASBA mandates can be tracked. Lien release depends on bank timelines. - Question: What if I was scammed or defrauded?

Answer: The portal can flag suspicious VPAs, but fraud should also be reported to 1930 and the cybercrime portal. - Question: Why can’t I find a transaction?

Answer: Sometimes apps crash before generating a UTR, causing “phantom debits.” Bank statements confirm whether money left the account. - Question: Can wrong UPI transfers be reversed?

Answer: Not automatically. Recovery depends on recipient cooperation and bank policy. - Question: Does cancelling a mandate stop deductions instantly?

Answer: Usually yes. If a debit is already processing, one final deduction may occur. - Question: Is this faster than app customer support?

For technical failures, yes. UDIR resolves most cases faster than app tickets. - Question: Does the portal store my UPI PIN?

Answer: No. PIN is processed only during authorisation and never stored.

Conclusion

UPI moved everyday payments from cash to instant transfers. The NPCI UPI Help Portal shifts control from individual apps to the payment network itself.

It helps users recover stuck money faster, stop silent subscription leaks, and manage mandates without switching apps or waiting on slow support queues. A simple mandate audit often reveals recurring charges that quietly add up over months.

For households, students, freelancers, and small businesses, the portal offers a practical way to maintain payment discipline in an ecosystem increasingly driven by automation rather than manual oversight.