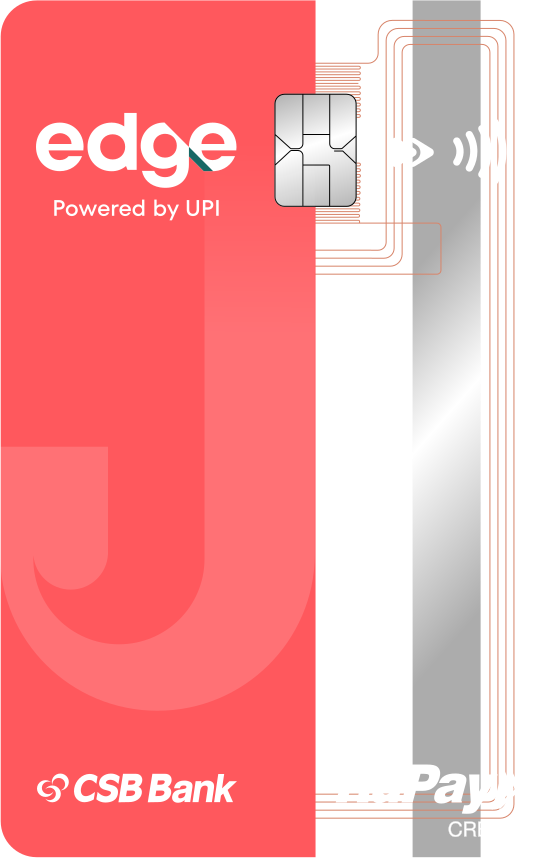

Hello, credit card users, are you looking to get a cashback credit card that suits seamlessly into your UPI lifestyle? The Jupiter Edge CSB Credit Card is a unique co-branded credit card designed for modern users or especially for those who prioritize rewards on digital payments.

Launched as a cashback credit card, it offers 2% cashback to cardholders in the form of jewels on popular everyday spends such as shopping, travel, and dining, and 0.4% cashback on all other purchases made via CSB Edge Rupay Credit Card.

Remember the earned cashback jewels as points can only be redeemed at a low rate of Rs 0.20 per jewel; the actual value you get while redeeming your cashback is too low, which can be a concern.

With seamless UPI integration, zero joining fees, and rewards on tap, this card is ideal for users looking for a simple app-first rewards system. But does it truly deliver value as a cashback credit card, or is it just a fancy rewards card under a different name?

Stay tuned as we explore the features, benefits, drawbacks, fees & charges, and more about Jupiter Edge CSB Bank Rupay Credit Card.

Likes to read alternative posts: Bihar Student Credit Card: Get Up To ₹4 Lakh Loan for Education (Full Guide)

Jupiter Edge CSB Credit Card Fee & Charges

| Schedule of Charges | Fee |

| Joining Fee | Nil |

| Annual Membership Fee | Nil |

| Fee to Issue Card | Nil |

| Card Closure Fee | Nil |

| Overlimit Fee | Nil |

| Annual Membership Fee (Add-On Card) | Nil |

| Forex Markup Fee | 3.5% per international transaction |

| Purchase Transaction Interest | 42% of the outstanding amount per year |

| Late Payment Charges | 2% of the amount outstanding, subject to a minimum of Rs.100 |

| Fuel Surcharge | Up to Rs.400: Rs.10 Above Rs.400: 1% |

| Auto-Debit Fee | Nil |

| GST | 18% |

How to Apply for Jupiter Edge CSB Credit Card?

If you want to apply for the Jupiter Edge CSB Credit Card online, then follow the given steps and know how to do it.

Step 1: Download the Jupiter App from the Google Play Store & Apple App Store.

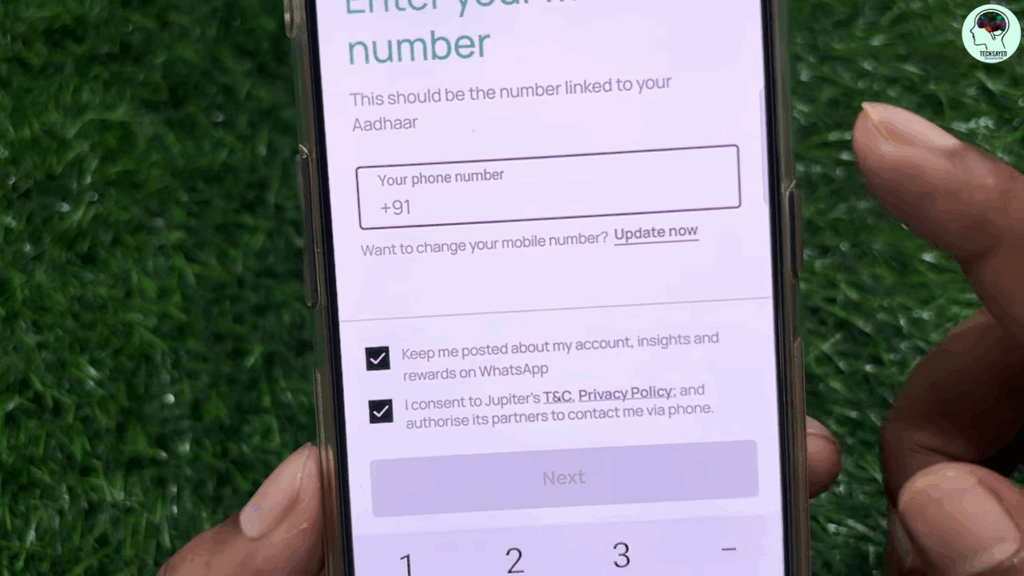

Step 2: Once you download it, open it on your device and start your registration process by verifying your mobile phone number.

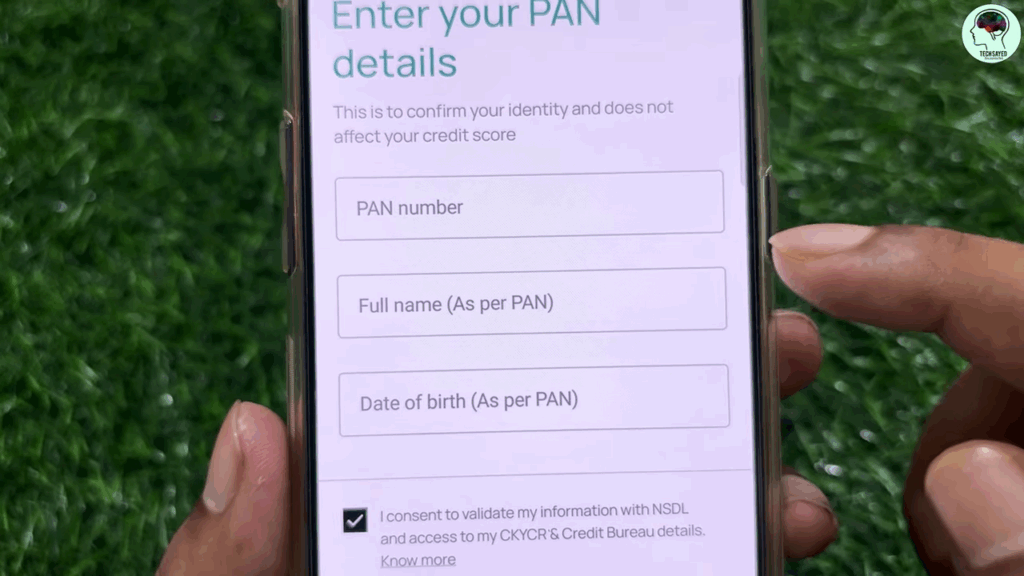

Step 3: After this, you need to verify your PAN number, set up your profile, and then click on Get Started.

Step 4: After this, you need to enter your personal details such as PAN Number, Full Name& DOB to complete the KYC process, which includes video-KYC verification.

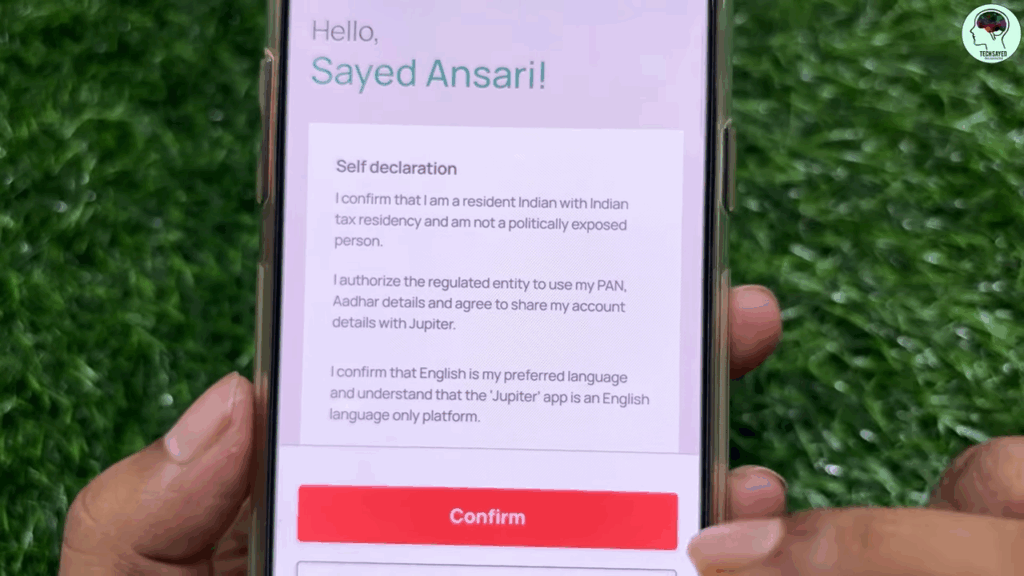

Step 5: Once you have successfully verified your PAN details, you will receive a confirmation message with your name at the top.

Step 6: Then check whether your name is correct or not. If it is correct, then click on the confirm button.

Step 7: After clicking on the confirm option, you need to set your profile by entering some basic details.

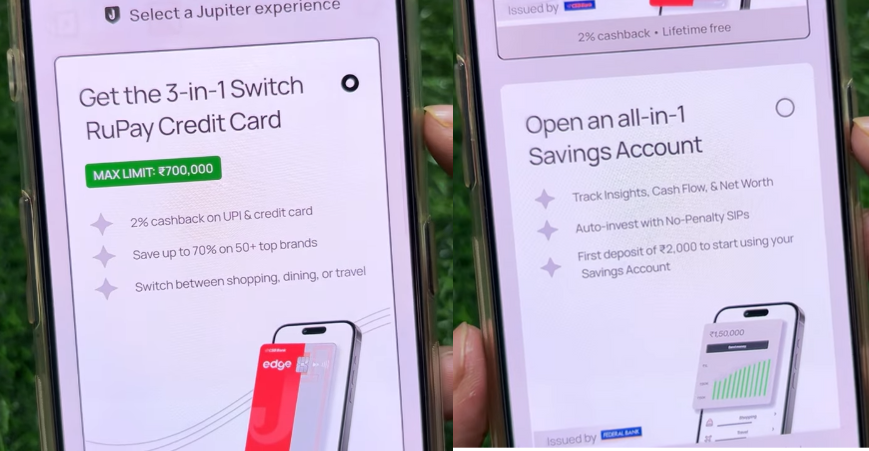

Step 8: Next, you may display two options on the device screen, displaying Get 3-in-One Switch Rupay Credit Card or Open an all-in-1 Savings Account.

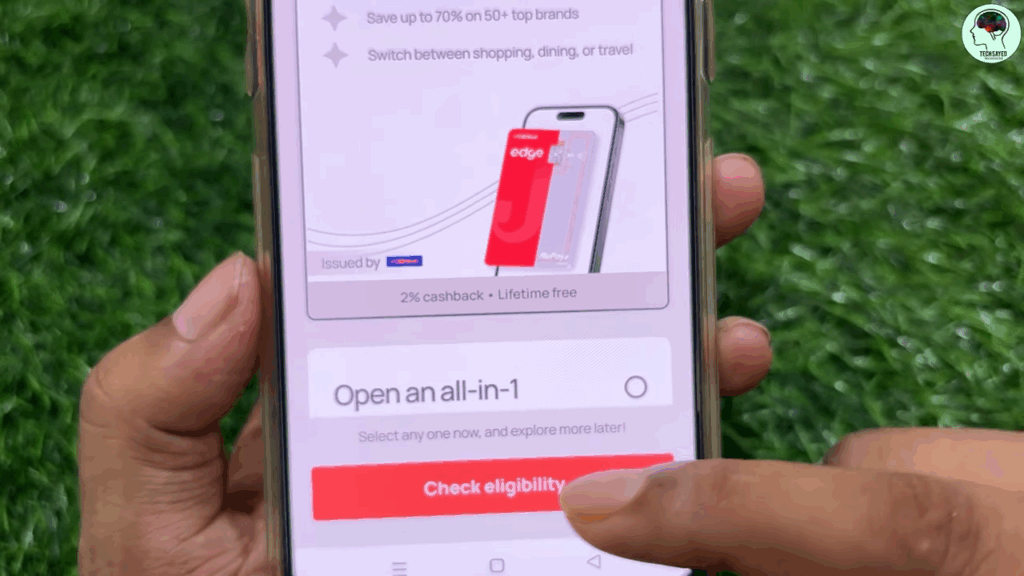

Step 9: Next, you have to select the Get the 3-in-1 Switch Rupay Credit Card.

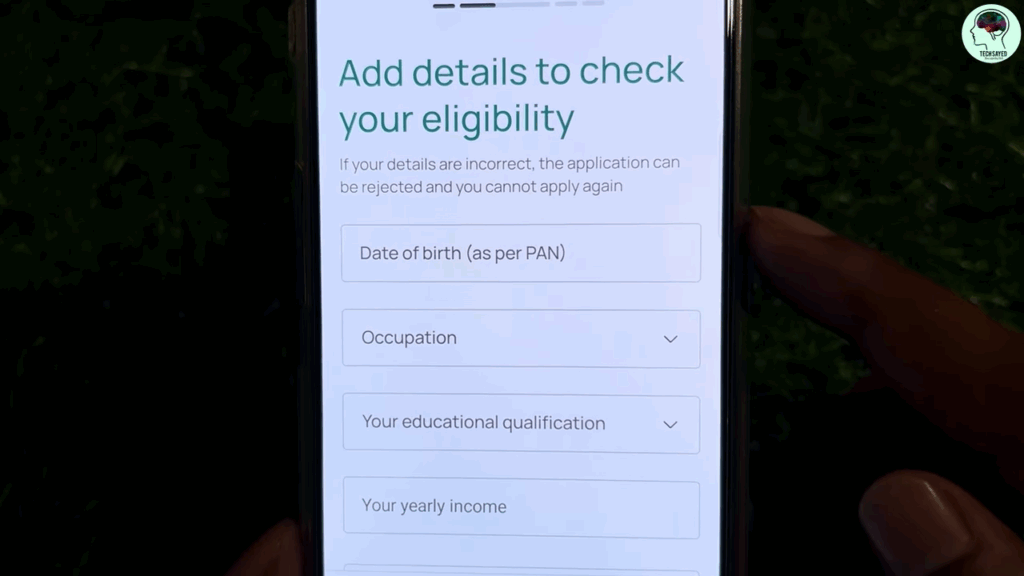

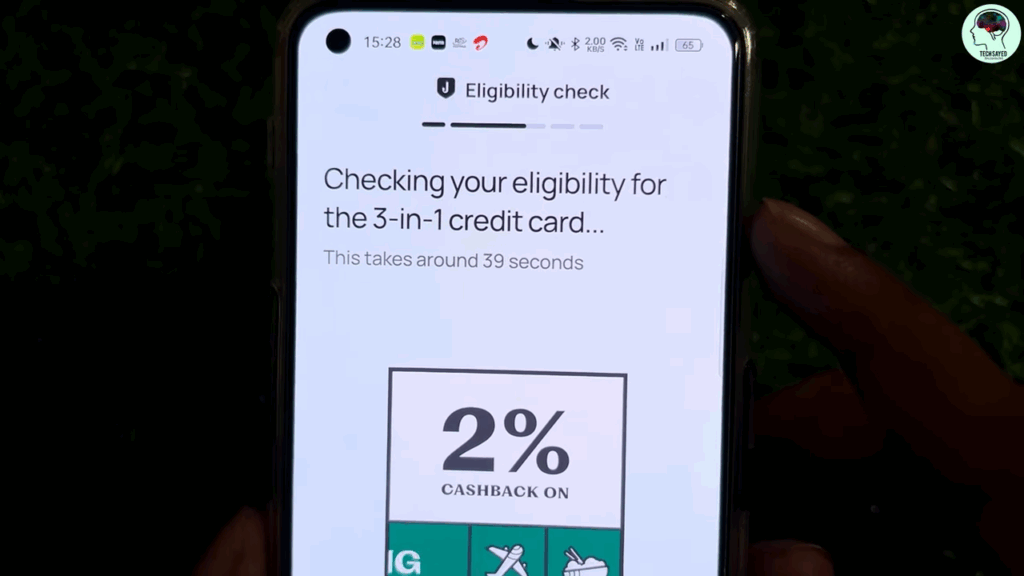

Step 10: After this, you need to enter some basic details to check your eligibility, including name, DOB, Occupation, Education, Yearly income, Delivery PIN Code, Tax Assessments, and others.

Step 11: After filling out all the required details to checking your eligibility, wait for a while.

Step 12: Once you are eligible for the card, your account may be successfully activated and you may see your Jupiter CSB Edge Credit Card virtually.

Note: You can also use it by linking it to your Google Pay and PhonePe accounts, and enjoy it by spending and earning rewards. The card may be delivered to your given address within 7 working days.

Features & Benefits of Jupiter Edge CSB Credit Card

Here are some of its exciting benefits and charges mentioned below:

- There are no hidden fees or charges that need to be paid while applying for it or at renewal.

- No annual membership fees need to be paid.

- The card is issued free of charge.

- Consumers get a flat 2% off on their preferred category, which includes dining, shopping and travel.

- Get 0.4% off on all other purchases.

- Customers may get Rs 250 on their first spend as a welcome voucher, when they spend first at partner brands like Swiggy, Zomato, Amazon & Flipkart.

- Get a limit of up to Rs 3 lakhs.

- Assured cashback on all UPI and credit card spends.

- Get personal accident and total permanent disability cover up to Rs. 10 lakh as an insurance benefit.

Rewards Redemption

Cardholders can redeem their accumulated jewels for cash credit through the Jupiter app, or as Digital Gold, or brand vouchers at a value of 5 Jewels = Rs. 1 (i.e. 1 Jewel = 0.20 Rs).

How to Switch Between Shopping, Dining, and Travel Categories?

Select your referred category between Shopping, Dining, and Travel.

- Use the Jupiter app, pay with your credit card or UPI.

- Earn 2% cashback on every UPI or credit card transaction in the selected category.

- You can switch to a different category after three billing cycles.

- All other purchases earn 0.4% cashback.

Pros & Cons

| ✔️Pros | ❌Cons |

| No Joining & Annual Fees | Monthly cashback capping of Rs. 3,000 |

| Accelerated Benefits on UPI spends for everyday categories like shopping, dining, and travel. | Cardholders can switch to a different category after three billing cycles |

| Welcome Voucher worth Rs. 250 redeemable at top brands | Low Reward redemption value of 1 Jewel = Rs. 0.20 |

Grievance Redressal for CSB Bank Edge Credit Card

| 1st Level Escalation | Customer Support 1. For immediate chat support, open the Jupiter app and click on the top right help icon. 2. Email your query to edge-csb-support@jupiter.money 3. Call 8655055086 and press option 4 for rupay card |

| 2nd Level Escalation | Email to csb.grievance@jupiter.money |

| 3rd Level Escalation | Email your query to customercare@csb.co.in Call on helpline number 1800-266-9090 |