Hi Guys, all of them uses Mobile and apparently we use SIM card of Idea, Airtel, Vodafone, BSNL, Jio. All the users have got the message from India Government to link your Aadhaar card with your mobile number.

So,if you want to know how to link your Mobile number with Aadhar card, then not to worry.

We are here to share with you the steps to link Aadhaar card.

As per the decision of the Supreme Court of India. It is compulsory to Link Aadhar Card to your mobile number in the time period of one year.

We are sure you must be looking for linking Aadhaar card, Airtel Aadhar Link, Idea Aadhar Link, how to add mobile number in aadhar card etc. or you may also want to know how to do Aadhaar number verification online & how to unlock Aadhaar biometric online.

However, linking Aadhaar card is free of cost and there is no stress in the whole process. And this process is a simple government process. It does not include any confirmations from government.

Online Method of Linking Mobile Number To Aadhaar Card:

Many of them prefer Online method Because it is easy and 2 minute Process So let’s Get started because last date of Linking to AADHAR near after that date Your mobile services will be Pushed untill you successfully link .

Below is the Full step how You Link Your mobile with OWN no need to go mobile stores for it.Follow the steps .

Requirement Before we started :

- AADHAR Number

- Your Mobile which you want to link to aadhar.

Follow the steps to Link Your AADHAR to mobile Number Online:

- First Of All Take Your Mobile which you want Link .

- Now from Same Mobile Number Call 14546 .

- As You call this number it will ask Your AADHAR number .

- Enter AADHAR number and Confirm it .

- Now you will Recive OTP on Your Linked aadhar mobile number.

- Now Simply Enter OTP on Call which is On (Do’t Cut the Phone :P).

- Bingo ! You linked Your Mobile Number to AADHAR.

- You also Recive confirmation Message within Minutes.

It is Compulsory To Link Aadhar Card With Your Mobile Number

As supreme court has made it compulsory to link Aadhaar card, so almost everyone has suffered a lot to do this process. So here are the steps which will guide you to link Aadhaar card to your mobile number.

Even there are steps for those who want to change their Mobile Number on Aadhaar Card. So here are steps for both the cases which will be easy for all of you.

Even the network providers like Idea, Vodafone, BSNL, Airtel, etc have send an SMS to link your Mobile number. This is the Message send by Airtel.

To link aadhaar card to your Idea, Airtel, etc there are 3 ways. So let us see the easiest way.

The Documents which are required to link the card:

Here is the list of documents which are required.

- Copy of Aadhaar Card

- SIM number

- The working SIM to get an OTP (verification code)

- Got OTP to complete the procedure

- Fingerprint for Biometric verification

Those who have JIO SIM cards should not worry as they are already linked with Aadhar card.

Here are the steps to Link Aadhar card on Store:

- First, go to the nearest shop which has a Network like Vodafone, Airtel, Idea, etc.

- Give your Aadhaar card and Mobile Number.

- Then, they will register your number and will get an OTP in SMS.

- Give the OTP number which is received.

- Then give your Fingerprint for Biometric verification.

- In just 24 hours, you will get confirmation message on your number.

- Reply, the message with “Y”, then your verification is completed.

- You are done ! Your phone number is linked with your Aadhaar card.

- This is the best and simple method. Even there are other methods which are given below.

Is there any Fee to pay?

As we have told you, Linking Aadhaar card is absolutely free. You don’t need to pay a single penny.

This is Offline Method to Link Aadhaar Card to Mobile Number.

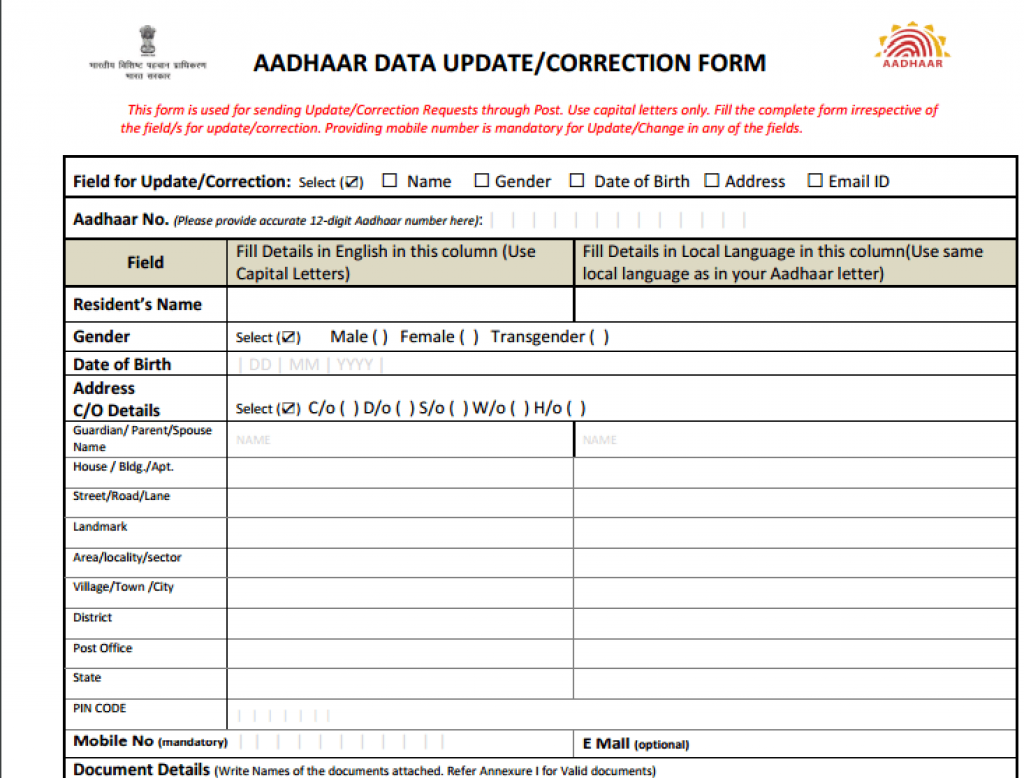

If you want to change or add your number already existing Aadhaar Card then you can follow the given steps. In this method you need to fill the form and send it to the given address.

Even you can use this offline method for changing your mobile number in Aadhaar card.

1.Download the Aadhaar card correction application form.

2. Take a print out of the form.

3. Select the “Mobile” option.

4. Give your Aadhaar card number.

5. Enter your name, address and other details.

6. Enter your mobile number which you want to add in your card.

7. Email ID can be given if you want.

8. Add a photo copy of Driving Licence, Passport, Voter ID Card, PAN Card Etc, as an identity proof.

9. In the end, selft attest all the documents by signing or thumb print.

10. Send the Application form to the address given below.

These are the Address to send Aadhaar Form:

You can send the form to any of the address from below.

Address 1 :

UIDAI Post Box No. 99,Banjara Hills, Hyderabad – 500034, India

Address 2 :

Box No. 10, Chhindwara, Madhya Pradesh – 480001, India

Soon you will get an official message on your phone after it is linked to your Aadhaar card.

We hope, you have understood these ways of linking your mobile number.

link mobile no my aadhar card

Please follow steps

you can link all

Adhar with mobile number link