In today’s digital era, Almost everyone has access to Credit Cards. There are few banks who have put their full efforts into distributing credit cards to eligible users via agents or on the basis of Preapproval to their existing account holders.

Credit card seems convenient mode of Payment Instrument because it’s like a Spend Now and Pay Later Service, And Yes most of us Obviously like to Pay Later.

EMI is one of the good service that almost every Credit Card company offer to their customers especially No Cost EMI , Because in No Cost EMI, the only thing that the customer needs to pay extra is GST On the interest amount.

EMI is a good thing to pay the loan amount in parts, But it seems a little stressful to those who can’t manage their finance properly.

In this case, EMI foreclosure is an option. We are going to list the charges that the bank deducts as processing fees for EMI Cancellation or Foreclosure. Please go through the post to know everything.

If You are looking for EMI Cancellation Charges Cardwise then I think this is the best article on the internet for you which will cover the EMI Cancellation charges for the major Cards in India.

Why EMI Cancellation Or Foreclosure?

Obviously! Why someone will cancel his/her EMI? EMI Cancellation and EMI foreclosure both terms are both related to each other and have the same meaning.

There could be various reasons behind cancelling EMI. The first reason could be saving of unless interest, and The Next reason could be to avoid the hassles of paying the amount in Parts, The other reason could be one has plenty of savings in his/her bank account.

Higher interest rates than other banks as well as Service Issues can also be the reason for Preclosing or Cancelling the EMI on Credit Cards.

EMI Cancellation Charges Bank Wise :

| Bank/Card Issuer Name | Applicable Charges | Cancellation Channels / Mode |

| Axis Bank | No Charges | Call Customer Care |

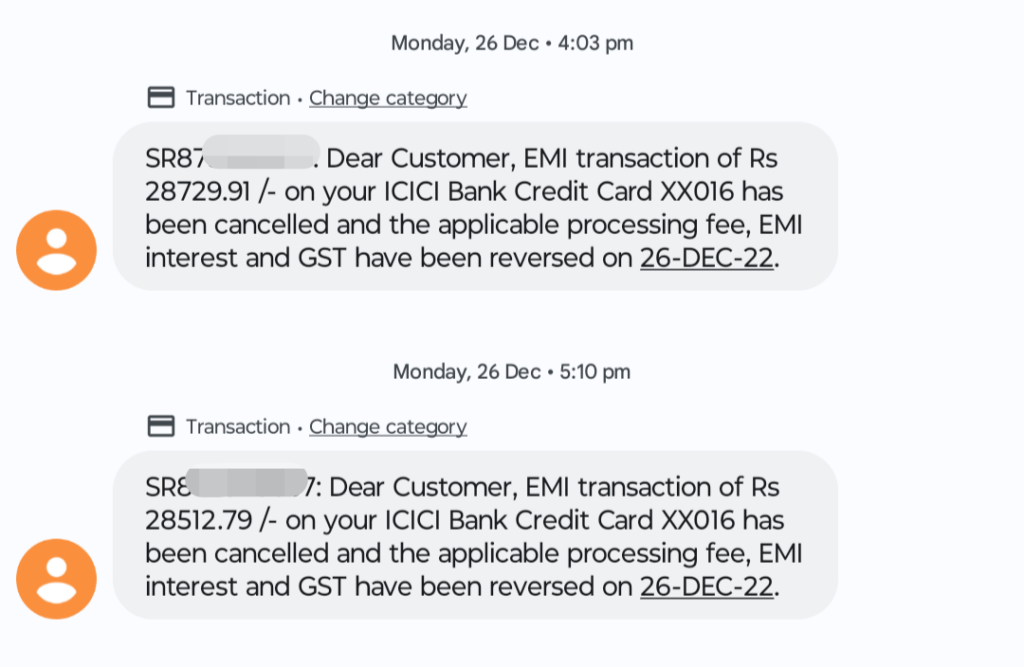

| ICICI Bank | No Charges | NetBanking | iMobile iPal ChatBot | Customer Care |

| CITI Bank | INR 250 – INR 500 | Customer Care | Online |

| HDFC Bank | INR 75 – INR 350 | MyCards Portal | Customer Care |

| AU Bank | 3% Of Outstanding Amt | Customer Care |

| IDFC Bank | 3% Of Outstanding Amt | Customer Care |

| Bank Of Baroda | INR 235 – INR 380 | Online | Customer Care |

| SBI | 3% Of Outstanding Amt | Customer Care |

| Kotak Bank | No Charges ( PF + GST ) | Customer Care |

| OneCard | 3% Of Outstanding Amt | Customer Care |

| Yes Bank | 4% Of Outstanding Amt | Customer Care |

| Amex Card | No Charges ( PF + GST ) | Customer Care |

| HSBC Bank | 3% Of Outstanding Amt | Customer Care |

| DBS Bank | 3% Of Unpaid Amount | Customer Care |

List Of Charges On EMI Cancellation Of Various Banks

Above is the list of all major Banks and the charges they levy as processing fees on EMI foreclosing as well as the channels through which foreclosure requests can be raised.

Within 2-5 Working Days Bank will process the cancellation request for EMI.

Risk Of EMI Cancellation :

As we know Personal Credit Cards are usually meant for Personal expenses only. If someone is using Credit Cards in Commercial Way then he might lose the relationship with Credit Card Issuer.

Cancelling multiple EMIs comes under Commercial Purpose, There is always the risk of losing access to a Credit Card if you are raising requests for foreclosing EMIs frequently.

So please don’t raise a request for EMI Cancellation unless you feel it’s a requirement.

Also Check : Easy Trick To Transfer Credit Card Money To Bank

FAQ’s :

Will I Earn Reward Points If I Foreclose an EMI Transaction On My Credit Card?

When Money Needs To Be Settled For Cancelled EMIs?

Through Which Method EMI Cancellation Request Could Be Raised?

Conclusion :

So guys I hope this post will help you all regarding the EMI Cancellation charges because I have tried to cover detailed information related to EMI Cancellation Charges.

If you have any further information related to this article then please help us improve this post by Contacting us on our Social Media handles.

Disclaimer: EMI Cancellation Charges Given here are collected from various sources on the internet. Before cancelling EMI please confirm with your bank their charges.

also check: Top 3 EMI Cards Which You Can Apply Without Any Credit Score