In this digital era, UPI apps have become a savior for Indians to make cashless transactions easily. Nowadays young adults and children are allowed to make their purchases and learn money management skills.

One of the smart apps that let children below 18 years make online and offline purchases are FamPay app.

So in this article, I will be reviewing this secure app and how to use it.

About the FamPay App

FamPay is India’s first payment app and card for young adults. It was launched in 2020 by Kush Taneja and Sambhav Jain who are IIT Roorkee graduates. It is a secure and convenient money management option without the need to set up a bank account.

FamPay allows minors below 18 to make online (UPI & P2P) and offline payments with its numberless prepaid card.

The company aims to raise awareness among teenagers and future generations about financial planning and making payments smooth for them.

FamPay allows parents to send money to their kids, so that they can spend it securely anytime, anywhere under their parents’ supervision.

It is super quick to send and receive money without having to worry about cash or checks.

FamPay also ensures the utmost safety and can be used for shared expenses like rent, utility bills, taxi fares, travel tickets, and more.

Features Of FamPay

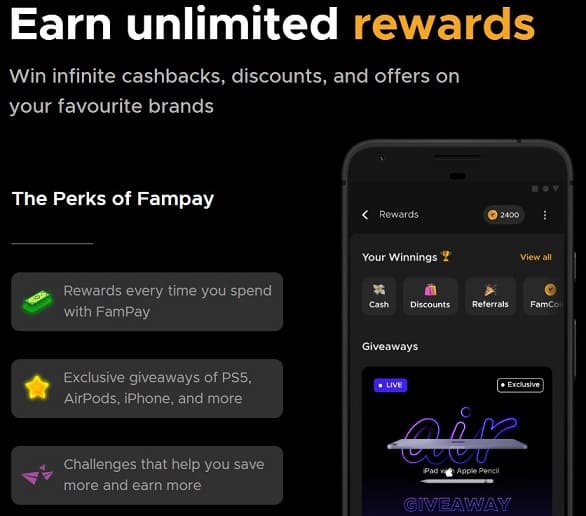

- India’s First Numberless Card: With FamPay you can get access to your card without the need for a bank account. Besides, you can make a personalized card that matches your style and vibe. Thus you can instantly transfer money and track your expenses from your fingertips. You will require a FamPay Zero balance account to set up an account in FamPay. Then you can have hands-on experience plus gamified challenges within the app.

- Enabling contactless payment: FamPay is introduced to ease India’s parents’ dilemma about lending money to their children. It doesn’t require sharing OTPs, cash, or payment apps. Parents can control and manage the transaction limits of their children. They can deposit the money into a prepaid account for their teens.

- Extra Security For the Teenagers: The FamPay card has no numbers on its physical card which makes it so secure. Moreover, the card details are stored securely within the Fampay app. So there is no fear of losing the card and its information getting disclosed. Plus the card can be blocked, managed, or paused from your fingertips in the app. Through these features, children get to learn about financial practice.

- Spend Less and Save More: Another added feature of the FamPay app is that it allows you to save your children from spending too much money. This feature is available for both online and offline transactions.

- Specially Designed Feature: Famcard has a contactless special feature introduced as Flash Pin, which is generated for every transaction. Young children can just flash the PIN for offline payments without the need to enter the PIN by themselves. Famcard World is just like any other bank’s debit card, so you can use it anywhere.

What are the benefits of a FamPay Card?

- FamPay card ends the child’s dependence on parents. But before starting to use this card, both the parent and teen must complete the KYC verification before use.

- The card allows the parent to send money to their child’s app and control their expenses.

- In Fampay app it has a social feed feature so that you can share your feedback and hear about your friend’s feedback and their expenses.

- Fampay allows you to access the card within 2 minutes without the need for a bank account.

- It is the go-to place for all your payment needs. It is specially catered for teenagers.

- The card offers FamPay cashback while you spend it. While you shop on your favorite brands it offers you FamPay rewards.

- It offers 100% secure payment which makes a safe experience for you.

- FamPay is partnered with IDFC’s first bank which is why it is the most secure neo-bank for teens.

- It doesn’t require the linking of bank accounts.

- In case of any payment issues, the reconciliation team will take care of the payment manually.

- FamPay is specially made for teenagers.

How to Use FamPay?

- Download the FamPay app from the Google Play Store

- Then set up your account and complete your KYC details verification.

- Invite your kids and get them to do their KYC.

- Order your FamCard.

- Start sending money to your kids digitally with ease.

- Now start saving/shopping on the app.

- You can use FamCard or scan and pay.

- You can also help your friends by sending money.

- You can use the Fampay invite link to send your friends and ask them to join this app.

also check Paytm App for PC,

FAQs

Can parents track FamPay?

Parents will be able to track where the money is spent from this account. They can pay to your personal wallet – This is your personal account where parents can send you money.

Can I use FamPay without a bank account?

Teenagers can make online and offline payments securely without the need to set up a bank account.

How many transactions are allowed in FamPay?

You will not be able to load more than INR 10,000 per month and INR 1,20,000 per financial year to a Min-KYC Wallet. The amount outstanding at any point of time in your Min-KYC Wallet cannot exceed INR 10,000. For Full-KYC, the load amount is not available.

Can I use FamPay after 18?

Yes! You can continue using the FamCard Me even after you turn 18+.

Is the FamPay card free of cost?

The virtual FamCard is free for everyone.

Conclusion

FamPay is useful for parents as well as their children. It aims to make payments smooth and easy to use for children. FamPay is safe and secure to use as it involves cardless payments. So make a free account with no fee or obligations.

Talk to your children and find a mutually agreeable solution to help them spend money and save wisely.