[updated : Dec 2019]Hello Earticleblog Readers ,

Hope You Are Enjoying Our Blog As Well As Saving And Earning Money Through Various Offers Which We Share On Our Blog . But What Will Happen When We Don’t Have Money In Our Hand , Our Savings Are Exausted & Our Earnings Are Paused ? Definately ! There Will Be Only One Solution To Hold Ourselves & That’s Taking ” LOAN ” From Someone .

According To Me : ” Taking Personal Loan From Someone Or Somewhere Is More Harder Than Earning That Particular Amount . ” . But , In This Post we will share the easiet way for PayTM Merchants to Grab Business Loan With PayTM & Pay them back In EMIs on daily basis which will be deducted from Payout Which is supposed to Released from Total Collections from the customers .

Also Check: Transfer Amazon Pay Balance To Bank Or Other Amazon Account

If You’re Looking for the perfect post on the internet regarding ” How To Get Business Loan from Business With PayTM App ” then trust me This is the Perfect article for you . Just follow the whole article and all of your confusions will be clear . Business with PayTM is ideal Loan service provider if You require short-term loan with Daily Re-Payment as option .

Eligibility Criteria For Business With PayTM Loan :

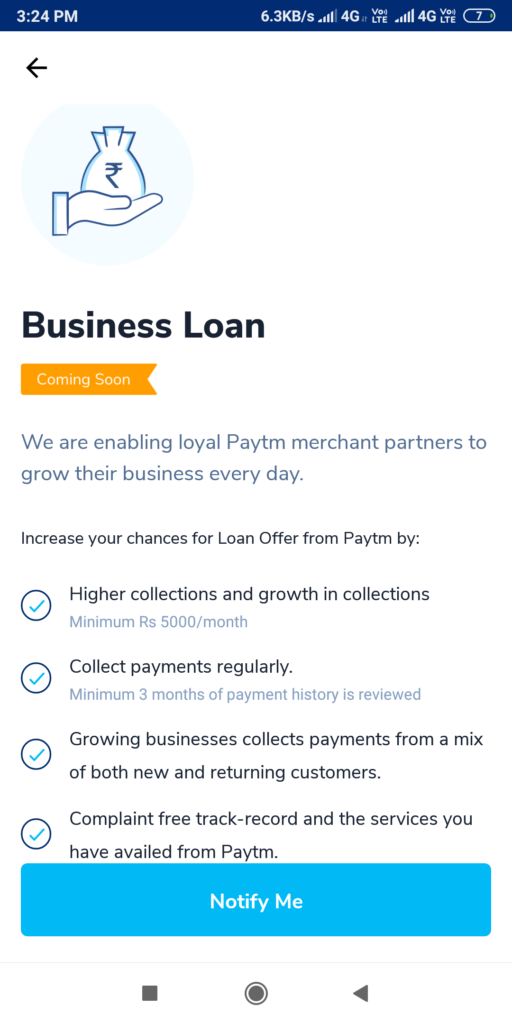

- If you accepts regular payments from your Customers , They have mentioned minimum INR 5,000 per month should be collected by the merchant & They can review 3 Months of Payment History Growth .

- Merchant should accept Payments from a Mix of both New and Returning customers

- Merchant should have complaint free track-record as Merchant as well as for the Services He/She have availed with PayTM .

As they have mentioned these specific things , I have added it in Eligibility Criteria section above . If You will follow all the steps and keep care of all the above things sooner or later , You’ll be eligible for a Business Loan With PayTM .

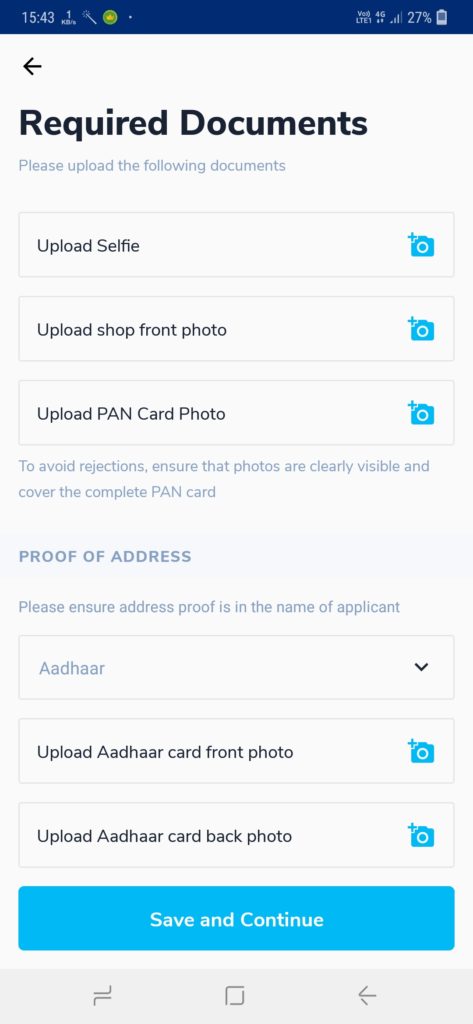

Required Things To Avail Loan From Business With PayTM :

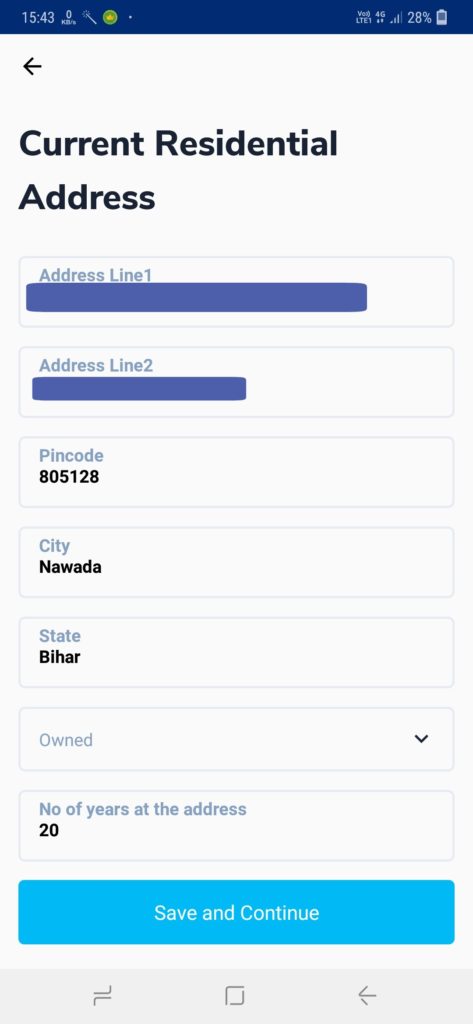

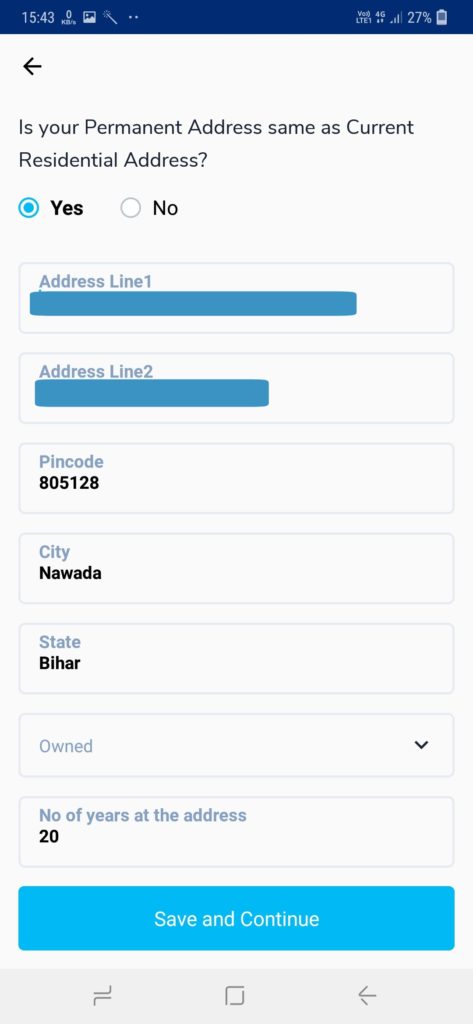

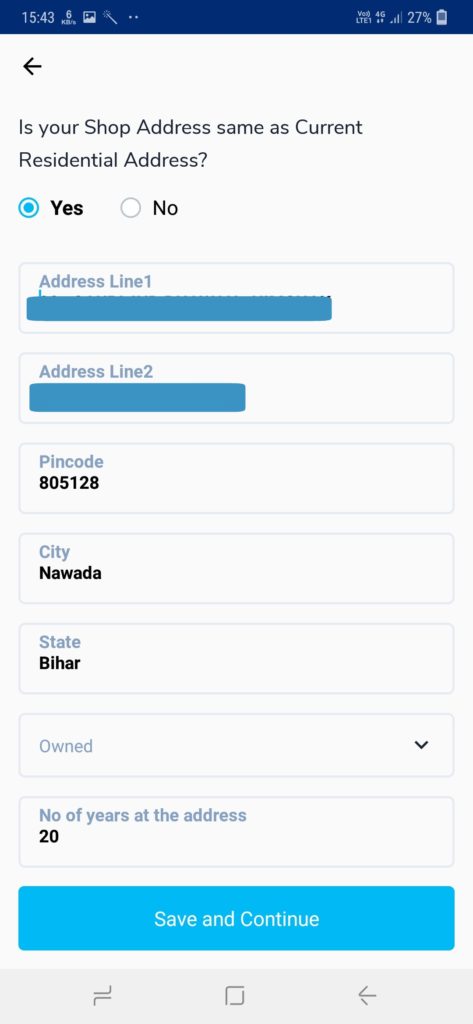

- Current Residential Address , Permanant Address As Well As Address Details Where Your Shop Is Located .

- Live Selfie Picture Of Business Account Holder

- Front Side Live Photo Of Your Shop

- PAN Card Photo From Gallery Or Live Click

- Proof Of Address – Any One ( Aadhar Card/Driving License/Voter ID Card/Passport ) From Your Mobile Gallery Or Live Click

Above Paperless Documents Are Required Only For A Single Time Verification , From Next Time You Can Avail The Loan More Conveniently . So , Above Documents And Details Are Required To Avail Loan From Business With PayTM Application

Steps To Avail Business With PayTM Loan :

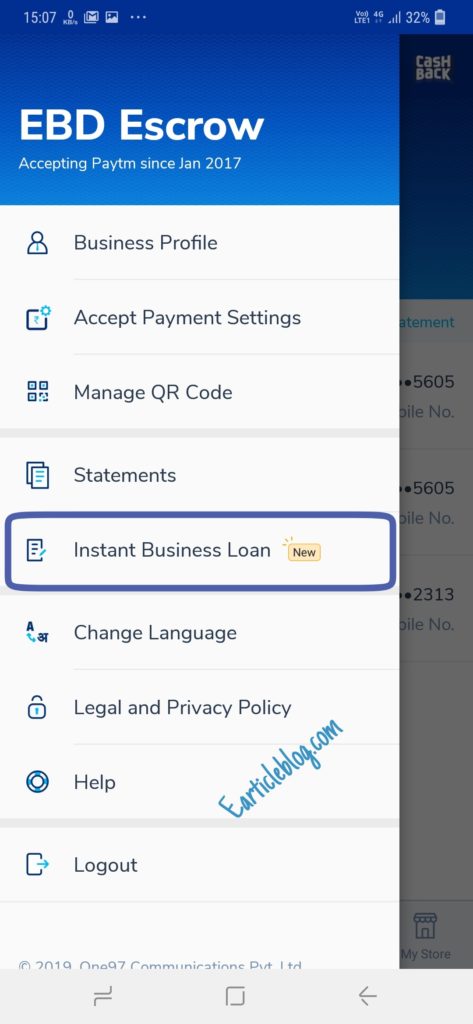

- First of all , Open Business With PayTM Application & Choose ” Instant Business Loan ” Option from merchant dashboard Or Just Click HERE

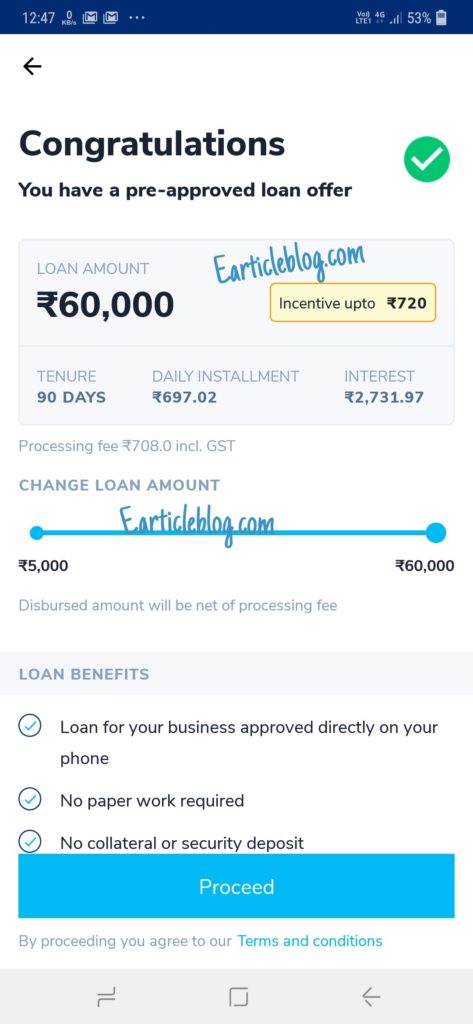

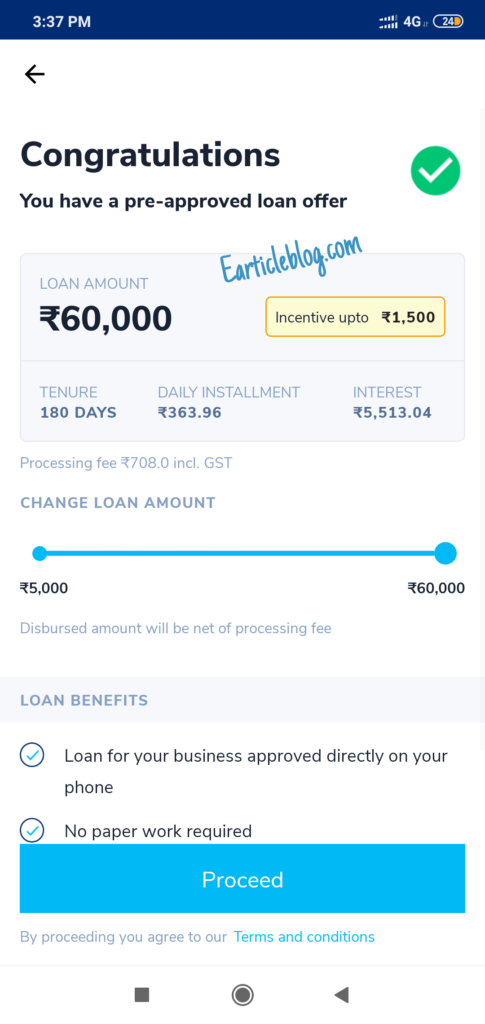

- At ” Instant Business Loan ” Page of Business With PayTM App , You’ll see option to proceed to the next step like this if you’ll be eligible .

You can see in above image . Different merchants are eligible for Different amount of Loans for different Tennures through Business With PayTM .

- If you are getting Layout like this with ” Notify Me ” Button then currently you are not eligible for the offer . That Means you should wait for few Weeks following Above Eligibilty Criteria .

So , If you are eligible for this Business Loan then please have a look at The below steps to Proceed Further .

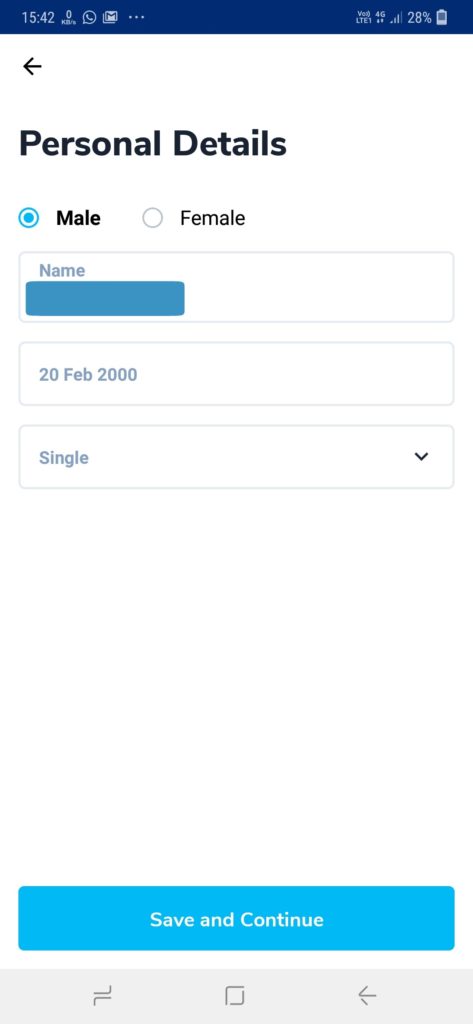

- Click on proceed from the Loan Screen & select your Gender , Enter DOB &

- Now , Select your current address where you are living at present .

- Now , Select Permanant address or Manually Enter if it differ from your current address

- Now , Enter your shop address if its different from Current Address else just Select Yes on the screen as per below Screenshot

- Its time to Provide Documents Verification , Upload the Required Documents to complete the process

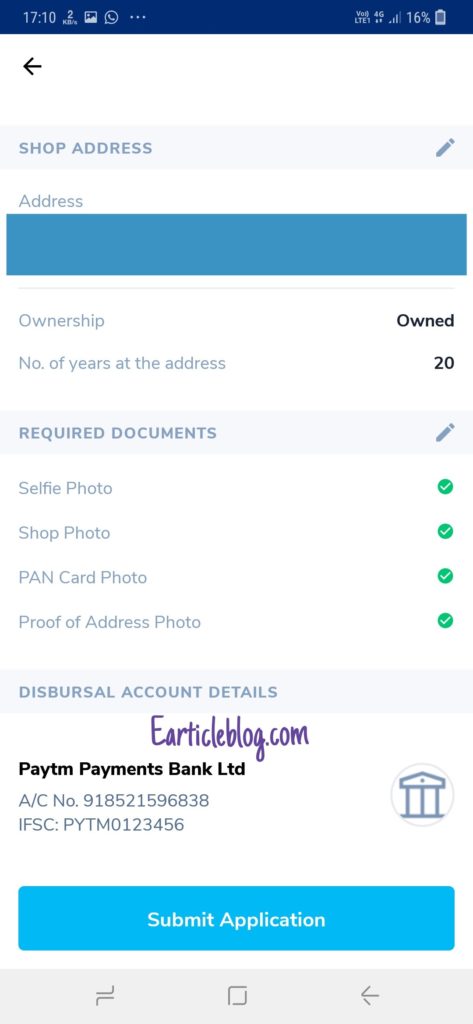

- After uploading Documents check these important details regarding loan disbursal

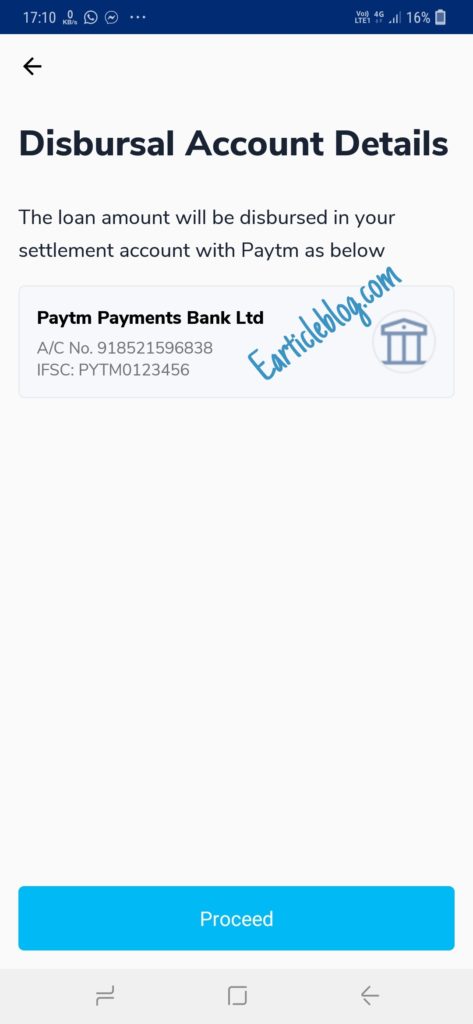

- Again Re-Confirm Disbursal Bank Account Details

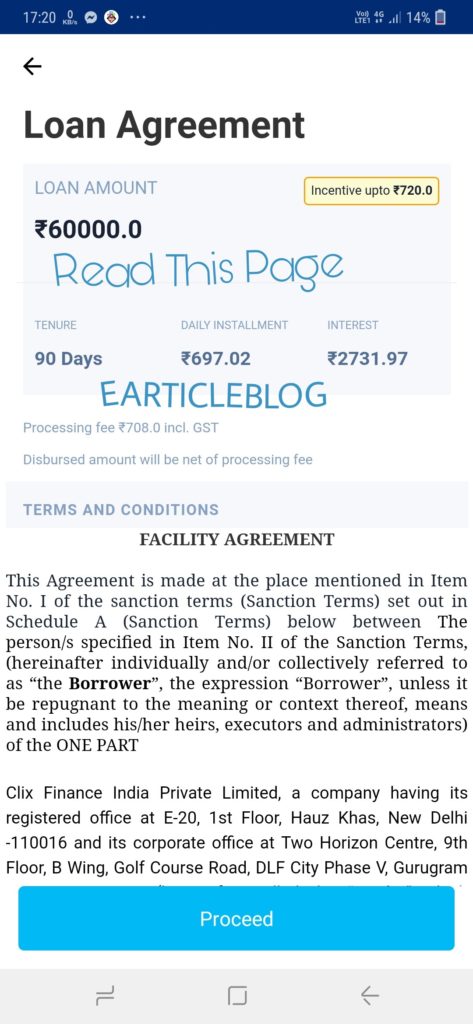

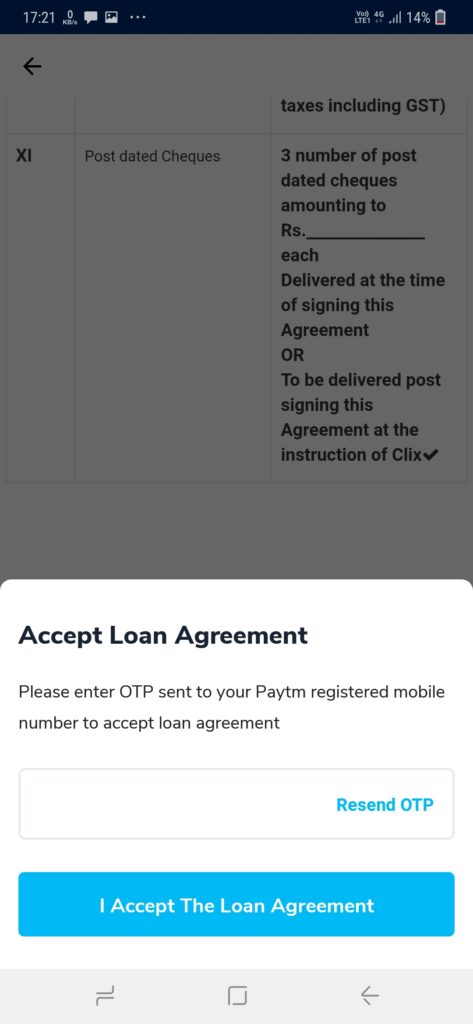

- Now On This Page Check & Read Loan Agreement Carefully

- On Next Page Enter OTP That You Have Received On Business With PayTM Registered Mobile Number To Accept Loan Agreement .

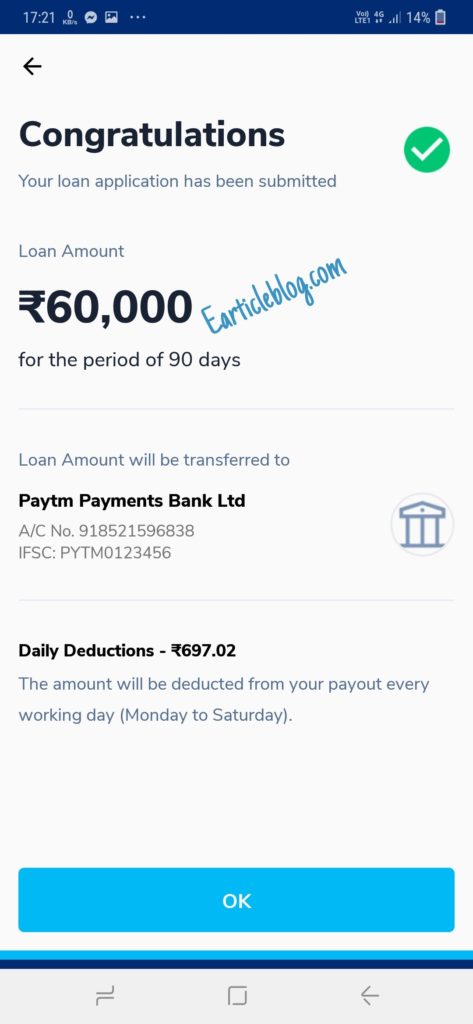

- You have successfully submitted the Loan Application . Now wait for 24 Hours for Business With PayTM Team to Review your Documents & proceed to approval & disbursal of your loan .

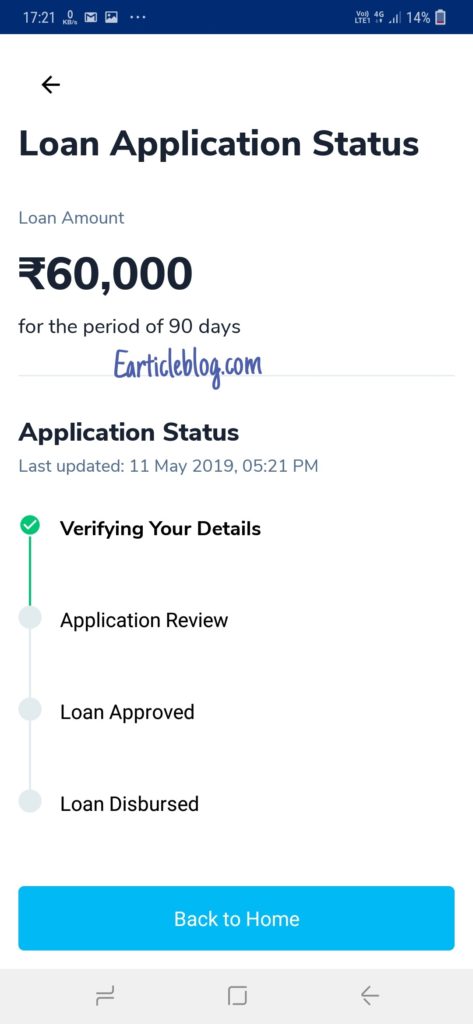

- You can always check your Loan Status from Instant Business Loan section on Merchant dashboard of Business With PayTM App

QUESTION AND ANSWERS :

Q . Does My Credit Score Needs To Be Healthy To Get Business With PayTM Loan ?

A . The primary thing that matters for availing Loan from Business With PayTM is the Relationship Of Merchant with PayTM . He/she should have Complaint free Track record and behaviour on PayTM Platform . Credit score also plays role in deciding your eligibility for this Loan . If you have bad credit score and Repayment history with other financial companies then this will Impact on the Eligibility .

Q . How To Pay Back Money To PayTM After Taking Loan ?

A . It’ll Automatically Charge From The Payout On Business With PayTM . If you have not received any recent payment from your Customers then you can send Equivalent amount of EMI Via UPI To your Merchant QR yousrelf , That’ll adjusted in The loan .

Suppose , I have EMI Due Of INR 500 & No One Has Paid Me INR 500 Today , Then I Can Send INR 500 To My Merchant QR Via UPI/NetBanking ( Netbanking = Payments Bank )

Q . What If I Will Not Pay Back The Money To PayTM After Taking Loan ?

A . After Month Ending , They will initiate a Chargeback in Your Payments Bank with Total Due Amount & It will be deducted from your PayTM Payments Bank . Read Loan Agreement for all other information related to recovery .

FINAL WORDS :

Guys , In this post i have shared the method and Eligibility Criteria to become eligible for loan from Business With PayTM Application . I have also added all the required details in this post . Apart from this , If you have any Query you can ask my anytime in the comments section .

Not got , But happy with explanation .

Very nice explaination

Thank you Sanskar. Do share it on Facebook or Twitter :)